When investing in the financial markets one can either use own stock picking skills or invest into collective investment instruments such as funds or holdings. Regarding pros and cons, please have a look at a previous video (no blog post, German): https://youtu.be/j-PMTlvhWIc .

Funds

There are different types of funds as pooled assets for investing:

- Open-ended funds e.g. mutual funds

- Closed-end funds (CEF)

- Exchange-traded funds (ETF)

- Hedge-funds

The major differences between an open-end and a closed-end fund is, whether the fund can output new shares or take back excess shares of the fund. A open-end fund is emitted by the fund company, which agrees to take back shares in the fund at NAV once a day and can also emit new shares at will. In contrast a closed-end fund (CEF) is offering its shares to the public in an initial offering and then is closed and goes with an IPO on a stock exchange. It then starts a secondary market and the shares can be traded on the stock exchange just like normal stock. But shares cannot be given back nor can new shares be created except for an official increase of capital by the fund investment company. Only other traders can buy the stock when someone wants to sell, just like in a normal equity market.

A exchange-traded fund (ETF) is somewhat in between, formally more a open-end fund but traded on an exchange like a CEF. A ETF is made possible by a market maker that ensures the liquidity of the fund and can, just like a mutual fund, create new shares out of thin air by buying more share of the underlying investment vehicle or selling it again.

Both open-end funds as well as CEFs are actively managed fund usually, while an ETF is usually a passive investment vehicle. There are some funds that call themselves ETF but are actively managed, brrr. The advantage of the ETF are the low total expense rates (TER) of below 1 mostly, while CEFs and open-end funds are usually above that. But mutual funds as main example of open-end funds tend to charge more with CEFs being in the middle.

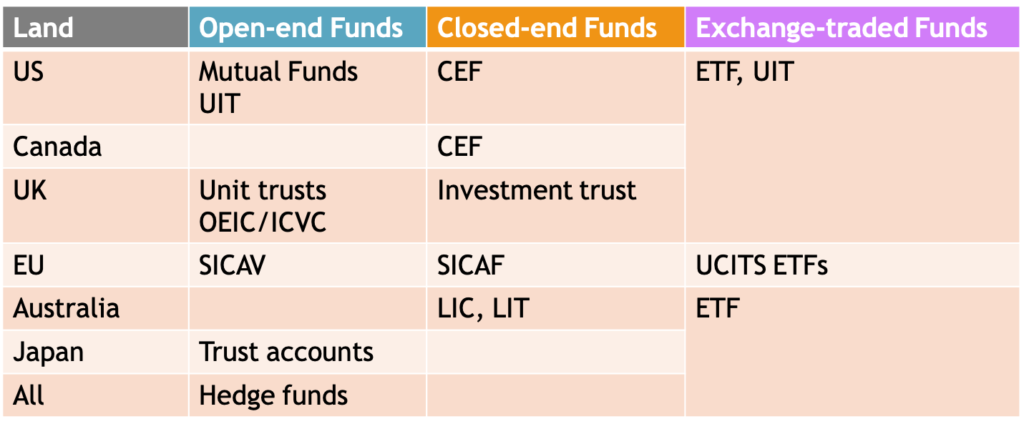

The most important open-end fund is the mutual fund but in the US there are also the union investment trusts (UIT) an interesting vehicle we could cover at another time. CEFs with this name are at home in the US and Canada. In the UK, we have unit trusts and open-ended investment companies (OEIC) versus investment trusts. Europe has SICAV (société d‘investissement à capital variable) versus SICAF (société d’investissement à capital fixe), where there is very little information about the later. Australia has listed investment companies (LIC) and listed investment trusts correspondingly. Therefore, the relevant countries for CEF-like investment vehicles are the US, Canada, UK and Australia, so the Anglo-American world.

ETFs on the other side, as we know can be distinguished into the UCITS regulated form in the EU and elsewhere, which are unfortunately hard to buy for European retail investors.

A hedge-fund can be seen as an open-end unregulated fund. We will see though, that CEFs can be seen as hedge-fund-lite in the sense which measures they can use in contrast to ETFs and mutual funds. And these hedge-fund-lites are available to the retail investor in contrast to real hedge funds.

Fund Market

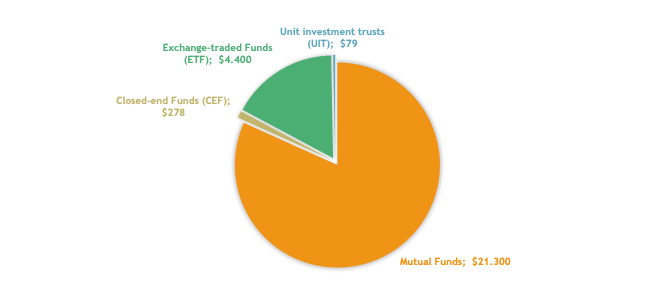

CEFs are a minority product compared with mutual funds and ETFs that catch up quickly. There are 123 thousand mutual funds worldwide, around 7.900 in the US, 8.000 ETFs worldwide and 2.200 in the US, whereas CEF there are „only“ 522 in the US.

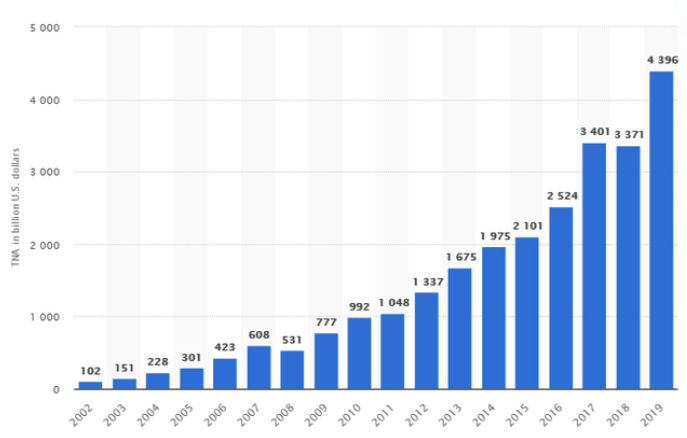

Historically mutual funds were first, CEFs second and ETF are the new kid on the block. Nevertheless the inflows into ETFs is staggering

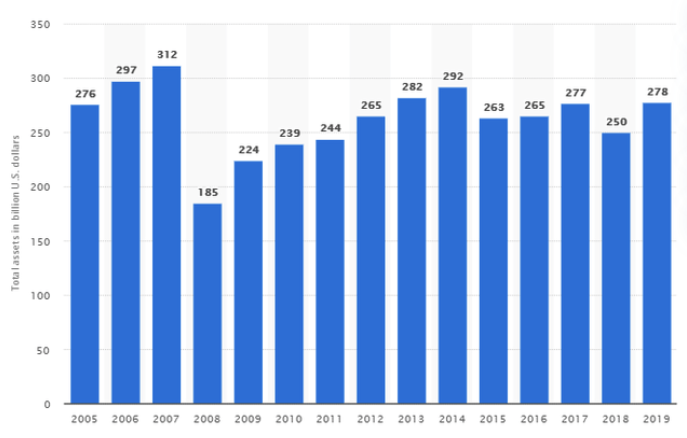

If you compare this to the development of CEFs:

What are the reasons for this? CEFs are often bought by retail investors as investment banks have their own asset management department and doesn’t need this vehicle. CEFs are usually smaller in size and for various reasons the price shows a higher volatility. Cost is higher than ETFs and they appear more complex as we shall see later. All this makes them more a vehicle for more experienced investors and not for the broad markets.

Furthermore many CEFs are merged or liquidated which leads to a rather decreasing number although larger funds.

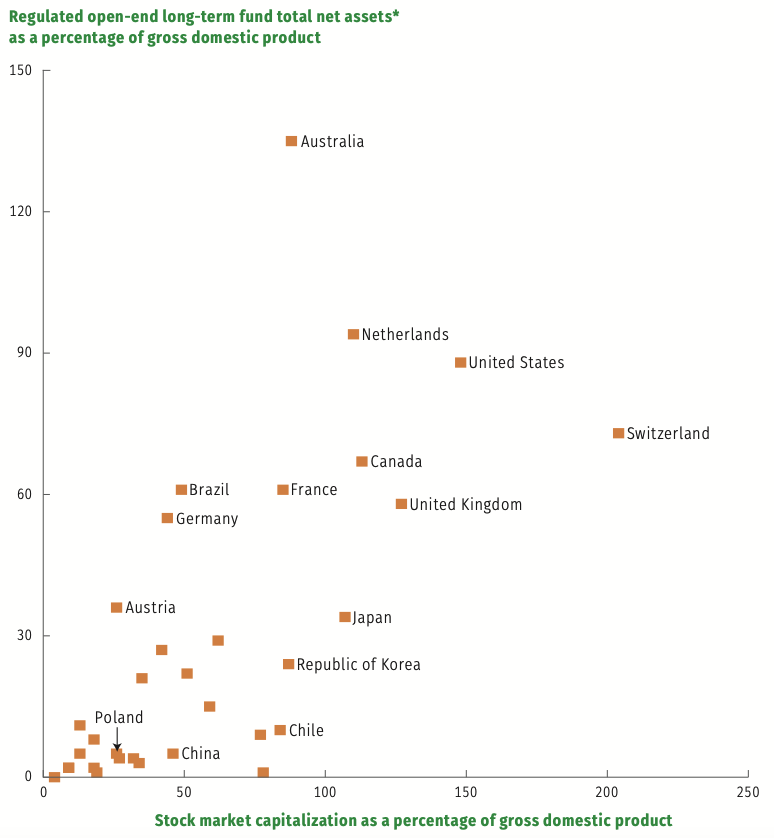

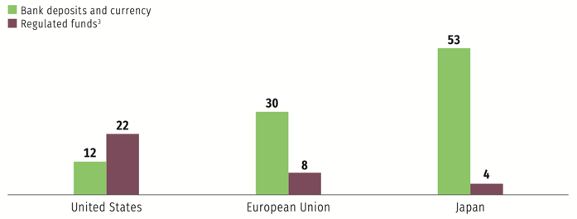

Overall investment into funds in general differs between countries. I remember myself, that I had mutual funds in the past, they didn’t perform well and I had been disappointed by the financial market in general, a classic. In the US a much larger part of the population is investing in the stock market and a lot of that goes into (regulated) funds. Whereas as we know European and much so Germans keep their money in the bank account. Even more so in Japan with its well established banking system.

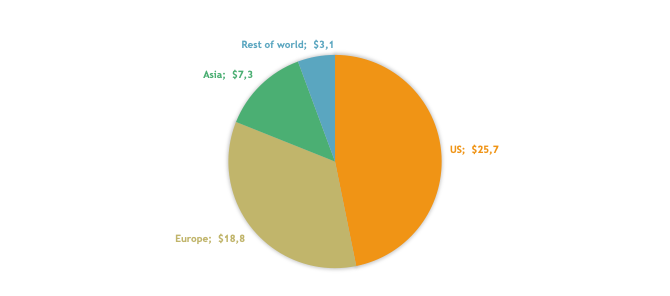

The US fund market started already 1929 is highly regulated. In the EU the UCITS regulation starts to make it easier for fund companies to sell funds all across Europe, at least one positive aspect of the MiFID II regulation. Asia has a very low amount of investment into funds but therefore a high growth potential.

Closed-end Funds (CEF)

But we want to concentrate in the following on the least known category, the CEFs. Why would it then be interesting to invest in CEFs at all? Well first for the Swabians among us, like me, there is an opportunity for savings included. Number 1, cost (TER) is usually lower than with mutual funds, although higher than ETFs of course as they are actively managed. Second in contrast to an ETF or a mutual fund, which are always trading very close at the net asset value (NAV) of their holding, except for a tracking error, a CEF has a higher volatility an can often be bought either at a discount or a premiums to the NAV. More often than not, this on average is a discount, so you get some extra yield when the CEF exceeds its NAV at a later time. I’ts like buying a bond at a discount in COVID-19 times, yeah.

But CEFs also have options at their disposal that mutual funds and ETFs have not. They can use leverage, options (e.g. puts) and other means to push up their NAV and thus the yields. This adds some risk though especially in tough times like last year. But in general when leverage is not used excessively, that can be a benefit especially for income investors. Much like a hedge-fund a CEF can do whatever it takes to make profits. The fund managers are rather free to invest in what they deem useful to get results and use debt, covered calls, issue bonds or preferred shares to get more capital for buying more assets and therefore earn more than its original inflow suggests.

By the way inflows. Especially mutual funds have the problem that they heavily depend on the sentiment of their investors regarding inflows and outflows of capital from their funds, see ARK. Which means they have to potentially sell assets in order to pay back shares when the investor returns its shares. With a CEF you cannot give back you shares, you can only trade to other investors at the stock exchange. That might mean less liquidity for the investor than what a market maker can offer, but for the fund it means more stability, it can think in the long-run as it is always fully invested. With the exception of deleverage when debt is too high in times of crisis.

Due to this internal stability, CEFs can also invest in less liquid assets, such as small caps that might offer an additional factor premium. This way CEFs offer a nice way to invest in markets that are otherwise hard to invest in for a retail investor such as not exchange-traded private equity. Again a hedge-fund-alike feature.

There is more good stuff, especially for European retail investors that are limited by the MiFID II regulation, such that they can only buy UCITS compliant ETFs and funds. In contrast to these, a CEF is an investment company with shares traded at a stock exchange just like stock. And that it exactly how they are treated, they are not limited by MiFID II and anyone can buy them from anywhere. Plus they are taxed like normal stock, too. So no tax on unrealised capital gains.

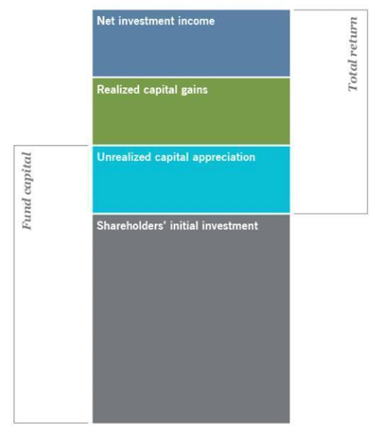

That brings us to the distributions, which is more than just dividends. Often CEFs are geared towards income investors and therefore they distribute monthly or quaterly, not just every half year. What do they distribute:

- dividends

- interest (if the asset class is bonds or the CEF does equity lending)

- return of capital (ROC), which could be

- passing through ROC of its assets

- Income from options e.g. covered calls on its assets

- Realised capital gains

- Further income from swaps or currency hedges

Usually when doing option business the CEF does that secured by its assets, using covered calls not the very risky variant of option trading. Like some brokers a CEF can lend its assets and gain a premium for that.

There are risks attached to these activities but without risk no opportunity very often. As long as it is well managed, that is all ok.

Regarding well managed. There are CEFs that distribute more than they should, e.g. if a CEF returns capital from its assets that is not good in the long run. It doesn’t have to be bad all the time though, a CEF can define by itself its distribution policy so it can decide to save some income and distribute it later, then it’s not out of its substance. But this point requires a close look in order to segregate good quality CEFs from bad ones.

So the following are criteria to look at to find a good CEF:

- Stable or slightly increasing valuation and price instead of continuously decreasing one. This is an indication of distribution out of the substance

- Stable or a tendency to increasing distributions instead of steadily decreasing ones

- Moderate cost (TER) of not more than 2,4 % instead of more than 2,5 % or even 3 %. TER will of course depend on the underlying asset, so cost might include additional interest for the debt and components like this.

- Limited leverage not excessive one. Values will depend on the type of asset again, I would compare CEFs in the same category.

Due to their flexibility, CEFs can invest in many asset classes plus the additional leverage etc.

- money market

- equity

- bonds

- loans, especially senior loans e.g. in form form of collateral loan obligations (CLO)

- Preferred shares

- Convertibles

- Covered calls on equity

- Real estate income trusts (REITs)

- Business development companies (BDC)

- Midstream energy master limited partnerships (MLP)

- etc.

There are CEFs in municipal, US, global market, emerging markets, in single sectors or multi-sectors. With CEFs you can invest in different investment styles, very often it is focused on income investing e.g. high yield equity but there are also growth stock funds with the CEF extra tools added.

CEFs as Tool

So how can we add CEFs to our portfolio in a useful way? As we have already mentioned, CEFs have often high distributions, so they are a investment vehicle for income investors. And the additional return of capital boosts distributions beyond dividends in addition to focusing on underlying assets that have high yields anyway.

The other use case is hiding complexity and working around limitations. There are investment vehicles like MLPs that only US citizens can invest in. By wrapping a diversified set of MLP stocks in a CEF all investors world-wide can invest in this interesting energy midstream sector.

Other vehicles are complex, e.g. preferred shares in the US are a great conservative investment but buying a single preferred share is difficult as much of its attractively depends on the share’s prospectus and its conditions. That requires expert knowledge. The same is true for convertibles, securities on equity, bonds or preferreds, that can be converted to common stock, depending on conditions and time. Exactly this timing might be difficult for retail investors.

Or take covered calls. Of course also a normal investor can sell puts on his equity (see Luis Pazos and Freaky Finance Youtube channel and podcasts for example). But it is a technique that needs to be learned and done in a way that minimises risks by securing the business by a portfolio of equity or preferreds. But until you feel save doing this, wrapping it in a CEF is much easier. So experts in the CEF investment company know how to do all these transactions, so they do something for their cost. You as a retail investor can buy the CEF just like a stock very easily and still be invested in convertibles, preferreds and covered calls.

Then some instruments are easy to buy, like REITs and BDCs as they are collective investments by themselves already and just normal stock. But the REIT and BDC market in the US is very large and it needs intensive study of this segment to be able to buy the right REITs and BDCs. By buying a CEF in these instruments you can let the fund manager make the decision with his sector knowledge and instead invest in a diversified portfolio.

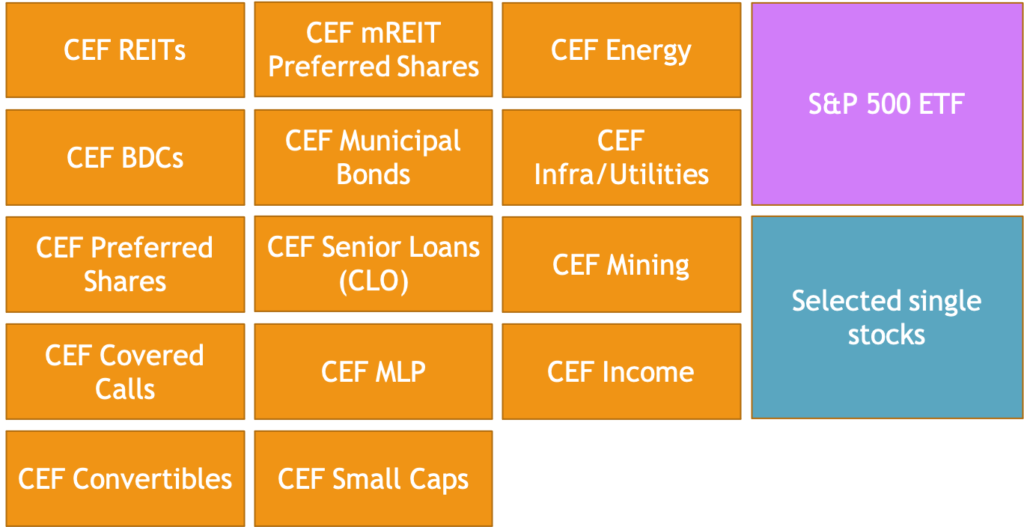

Finally the US market as a whole is the largest world-wide. Now we can simply buy the whole market by investing in an ETF. But this way we buy also the expensive growth stocks as well as the laggards as well as the value stocks that we search. So the other way would be to cover the US market using specific CEFs to diversify well. It is easy to cover certain sectors like energy, midstream, mining, REITs and BDCs with CEFs.

Also instead of investing in bonds, which do not offer yield any more, one could instead invest in CEFs in preferred shares either on general stocks or e.g. the riskier mREITs, that one would maybe skip for common shares.

Especially investments in selected small caps and non-exchange listed companies is easier with CEFs than with ETFs where all assets must be listed.

That does not mean that one could not augment that with an ETFs in e.g. the S&P 500 and selected some stocks for fun. I’m not totally convinced that CEFs on general equity is so much superior to an ETF. Just the special CEFs I’m convinced. So having both for the right sectors and vehicles would be the golden way to go.

Infos on CEFs

To get more information on CEFs and find suitable vehicles, there are some CEF portals

Especially the later I find useful. As I have mentioned initially there are CEFs not only in the US but also in Canada, Australia and UK. On the stock exchanges of these countries there are also special pages on CEFs

The following fund companies are issuing CEFs (not complete):

- Aberdeen

- Blackrock

- Calamos

- Cohen & Steers

- Duff&Phelps

- Eaton Vance

- First Trust

- Gabelli

- Guggenheim

- John Hancock

- Macquarie

- Nuveen

- Pimco

- Voya

- etc.

Summary

We’ve seen that closed-end funds are a minor but very interesting investment vehicle especially in anglo-american countries for income investors and as a tool for complexity and limitations in the market. Instead of single stock picking we can also cover a good part of the US and other markets using CEFs to exploit the greater options that a CEF has in contrast to ETFs and mutual funds like hedge-funds for retail investors.

In the future we will have a closer look into special segments of the CEF market, stay connected!

Comments are closed