Luis Pazos, expert for high dividend values has published his 4th book in April 2020, „Geldanalage in Preferred Shares„. We want to take the opportunity to delve deep into the asset class of preferred shares in this article.

Preferred shares are a form of mezzanine capital that can be emitted by US and Canadian companies that could be translated in German by „Vorzugsaktien“ but it has little to do with these, as we shall see.

In the US, only financial institutions, utilities, infrastructure companies in the energy sector, RETIs and BDCs can issue preferreds, as they are called in short. In Canada all companies can issues these.

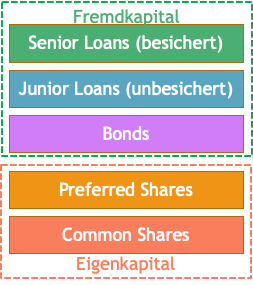

Preferred shares are usually part of equity, although they can be structured like dept as well, with properties of long-term debt and are thus a capital finance means in between loans and bonds and common stock.

Preferred share names carry the parent equity in their name and are emitted in series, where each series could show different characteristics that are outlines in the investor material. Usually the face value at time of emitting is 25 USD or CAD and preferreds pay either a quarterly, mostly, or monthly fix dividend. Common to all preferreds is that they have no voting rights in contrast to common shares. Usually preferreds have a fix dividend but there are also floating, that is variable dividends that follow some interest index.

Preferred shares are traded like normal common shares at the main trading places, the Toronto Stock Exchange (TSE) and the New York Stock Exchange (NYSE).

Preferred Share Market

The market for preferred shares in the US is around 500 billion USD, in Canada 73 CAD and there are around 600 listed preferreds in the US and 400 in Canada, which is given the difference in number of people and capitalisation of the stock market in these countries quite impressive for Canada.

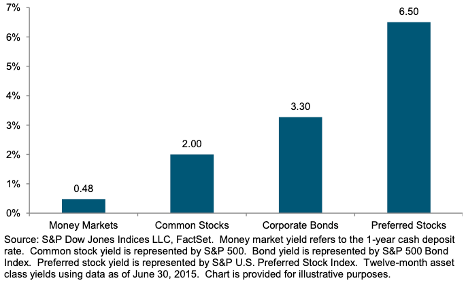

Preferred shares are often bought by institutional investors but also retail investors following an income strategy. This is due to the interesting yield of preferreds in comparison with corporate bonds and also common stock in the average. As income investors we are usually only interested in shares that yield more than 5% but understand that the general market yields much less. Therefore preferreds are a very interesting instrument for us.

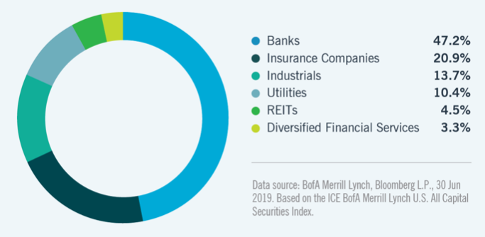

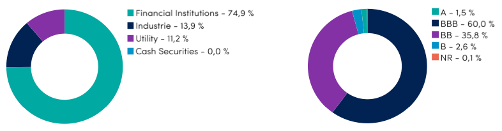

As in the US only certain companies can emit preferred shares, the sector diversification is very much focused on financial institutions that emit over 48% of all securities, followed by infrastructure, utilities and REITs. In Canada, the sector diversification is still more than 50% banks and insurances but a bit better diversified.

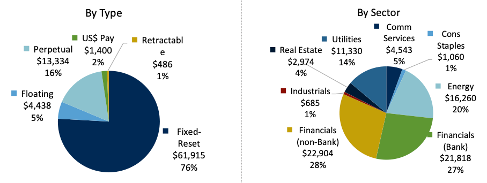

Most preferreds are fix dividend with a reset (redeemable), only a minority has a floating rate and 16 are perpetual (no end date). In total preferred shares only make up a minor part of the US and Canadian securities market, with common stocks and bonds being a much much larger market.

Properties of Preferred Shares

Now why are preferred shares interesting for companies as a capital class? Preferred shares are part of the equity like common shares but share properties with bonds, which belong to debt. In contrast to bonds the management can decide to not pay the fix dividend of preferreds in a year with financial difficulties just like the dividend of a common stock can be shortened or not be payed. There is though a difference for all cumulative preferred shares, and most are not non-cumulative, which means that the fix dividend needs to be payed to the preferred share holds in the following years. Very often there is also a paragraf in the investor material that states that the common share holders will not get a dividend in the following year until the dividend of preferred shares has be re-payed for the previous years. This really makes the preferred share holders „preferred“ not only in the seniority of the capital but also regarding dividend payments.

In financially difficult times companies will first not pay a dividend to common share holders, then in urgent cases only, due to the negative visibility on the capital market, skip the fix dividend of the preferreds. If the company cannot pay the interest of their bonds on the other hand then the company goes into insolvency, because bonds are contracts with a lender, usually a bank and that is a different severity to break than not paying a dividend for shares in equity. Therefore preferreds are expensive for a company but give it a huge flexibility that make this asset class both attractive to the emitting company and the investing share holder.

The second property of preferred shares is that they often have a call date 3 to 5 years after the security is emitted, which is when the paper can be retracted by paying back the face value of the preferreds. This is in stark contrast to bonds that have to be payed interest until the previously fixed maturity date. Note that the calling of a preferred is optional, the company does not have to do it, it optionally can. Especially when the financing conditions of capital improve the company can decide to redeem the preferreds and emit a new series with a dividend more favourable to it, especially when interest rates decrease. This gives superior flexibility over bonds, where such calling is not possible. Of course calling a preferred is accompanied with costs, so a company will only go through this procedure if it is worth the difference and in these times of rather increasing interest we can expect longer running preferreds in the future.

This property of a call date does have some impact on the behavour of preferred shares. Before the call date the price of the shares will have a larger volatility, although less than the common shares but towards the call date and beyond it will very much stay close to the face value 25 USD or CAD. This is because if the price is lower the owner has a right to get the face value and makes a win and therefore the discount won’t be large otherwise the market would not be efficient, given the solvency of the emitter. On the other hand the price will be be traded with a large premium either as that would mean a sure loss when the paper gets called, which can happen any quarter or year based on an internal decision in the company that is not transparent to the stock market. This means that preferred shares around and after call date will show a very stable price chart, which is an interesting property for a defensive investor. When the shares are called, the company pays the face value or some premium previously defined in the investor documents.

Preferred shares, like bonds are sensitive to interest rate changes but not as sensitive as bonds. The interest risk is lower because of the inherent risk of calling (call risk). Like a bond the price will near the face value when the call date comes up.

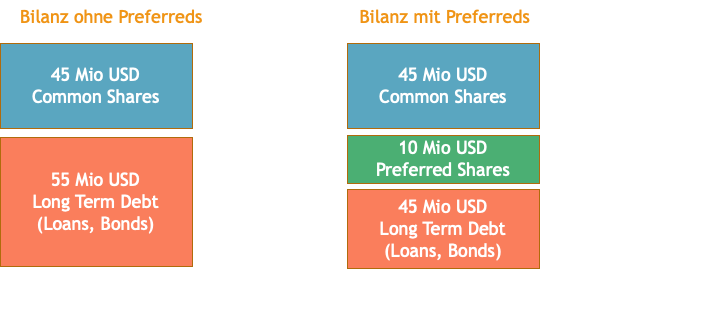

Preferreds are very interesting to companies through the possibility to shape the balance sheet with them. Comparing a company with and without preferred shares (example from Luis Pazos‘ book). On the left hand side without preferreds the equity rate is 45%, while on the right hand side with preferreds it is 55%, because preferred shres belong to equity. This is on the one hand expensive for the emitting company because due to the flexibility it will have to pay the investor a premium e.g. a fix dividend of 5.5% in contrast to a interest rate of 3% on the left hand side. But investors will look at the ratio EBITDA to dept and having higher equity will improve the picture to the market and does also improve the credit worthiness of the company, which would now get a lower interest rate for its long-term debt of e.g. only 2%. In sum that will give the company overall lower capital cost than without preferred shares far outweighting the cost for the fix dividend. And capital cost is a very important KPI for investors (see e.g. Dr. Andreas Beck).

Investing in Preferred Shares

As usual there are different ways how to invest in the asset class preferred shares:

- Invest in single preferred shares

- Invest in a ETF based on a index of preferred shares

- Invest in a CEF that hold preferred shares

- Invest in preferred shares of funds like CEF that emit these

In the following we will look into each of these options. First preferred shares in this form only exist in the US and Canada so we will have to invest in securities from these countries. In the US there are normal preferred shares and covered preferred shares and in Canada there are also normal ones and preferred shares from split companies and split trusts, both of which are covered.

Preferred Share Names

The name of a preferred share will tell already a lot about its basic properties. It contains in its name

- Name of the parent asset common share e.g. ACME

- Cupon of the fix dividend e.g. 6.25%

- Series name e.g. Series-B

- If the preferred does not have a fix dividend but a variable one the name contains floating. If the dividend type change at some time after emitting it will contain fixed-to-floating in the name

- A preferred can be cumulative if it repays dividends or non-cumulative

- It can be redeemable or non-redeemable if the preferred can be called or not is often is also then called perpetual or contains something like due <year>

- A convertible preferred share means it can at some time be converted to common shares or non-convertible, which is the normal case

The ticker of a preferred share also reflects the parent asset with a postfix „PR“, e.g. „ACME.PR.Series-B“ or „ACME PR B“ or „ACME-B“ depending on the country, stock exchange or site that provides information on the security.

Preferred Share ETFs

While in the US there are a total of 17 exchange traded funds (ETF) that invest in a index of preferred shares, in Europe there is exactly one left after the VanEck Vectors Preferred US Equity UCITS ETF was liquidated, probably due to its low volume of assets under management of only 4 Mio USD. Remaining is the Invesco Preferred Shares UCITS ETF with 26 Mio USD assets under management with physical replication, 4.4% yield, distributing and EUR hedged with a TER of 0,55%.

The ETF looks very promising with its very flat and stable price development, which is perfect for parking money as the defensive part of a portfolio. Only downside is of course the short history and a typical high exposure to preferreds from financial institutions.

Rating are not bad when compared with the ratings of ETFs or CEFs that invest in corporate loans and bonds, that usually tend to have more single-B and some C ratings as well.

It is a pity that there is only one such ETF with the danger of being terminated as well, which again shows that the MiFID II regulation reduces the available investment vehicles especially in these non-standard corner of the financial market.

Preferred Share CEFs

There are equally many closed end funds (CEF) than ETFs in the US market (17). And in contrast to the non-UCITS ETFs European investors can easily invest in CEFs as they are traded like common shares and are not regulated by the MiFID II regulation. According to cefconnect there are many CEFs in this asset class but only 2 of them trade with a discount, while all others trade with a sometimes considerable premium. For a value investor a premium is a problem as you pay more than one Euro per Euro of underlying assets, something to avoid.

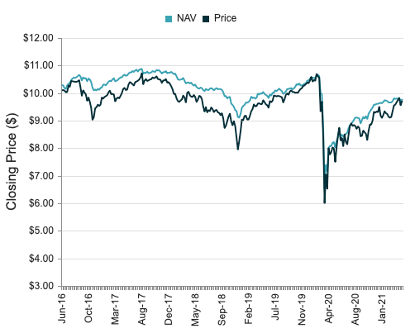

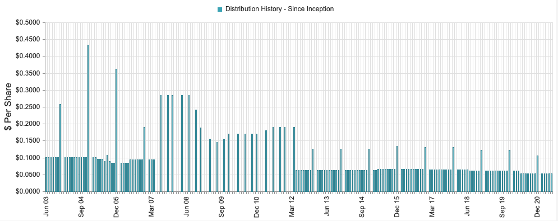

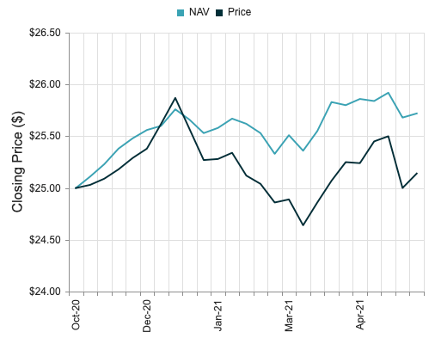

One of those two CEFs with minimal discount of 0.1% is the Nuveen Pref & Income Opps Fund (JPC) traded on the NYSE. With around 1 billion USD asset under management, 248 holdings, 35,6% leverage, TER of 2.5% and a monthly yield of 6.49% it is one of the more conservative CEFs in this field and therefore interesting for the defensive part of a portfolio.

Some weeks ago there was a small dip and a chance to buy this fund with a few more percent of discount.

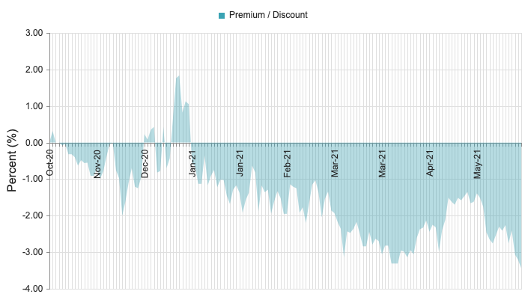

The other CEF is Cohen & Steers Tax-Adv PRD SEC and INC (PTA) only emitted October 2020. With already 1.294 Mio USD assets under management, 232 holdings and a 6.25% monthly yield the CEF does not publish TER and leverage yet.

The increasing discount is typical for newly emitted CEFs that for some reason first loose valuation. Therefore it might still be time to watch this CEF for a while until the discount development starts reversing.

Single Preferred Shares

Finally we can of course also invest in single preferred shares directly on the TSE or NYSE. These are emitted by banks, insurance companies, infrastructure companies in the energy and telecom sector (Canada) as well real estate especially RETIs and from funds like CEFs.

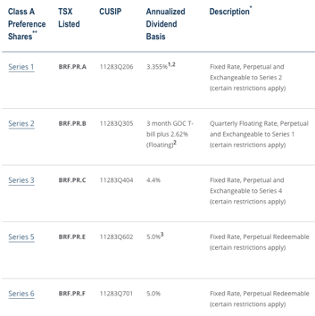

An example of the different series of preferreds from Brookfield Energy Partners (BEP):

There are ratings for preferred shares like for bonds from Standard & Poors and DBRS categorising these into investment grade for superior or satisfactory levels and non-investment grade for the other levels.

| S&P | DBRS | Level | Kategorie |

| P-1 | Pfd-1 | Superior | Investment-grade |

| P-2 | Pfd-2 | Satisfactory | |

| P-3 | Pfd-3 | Adequate | Non-investment-grade |

| P-4 | Pfd-4 | Speculative | |

| P-5 | Pfd-5 | Highly Speculative |

Covered Preferred Shares

A special category of preferred shares are those that are covered by assets of the underlying company. This is especially the case for preferreds from BDCs, covered by 150% only and CEFs, usually covered by 200% by assets of the fund.

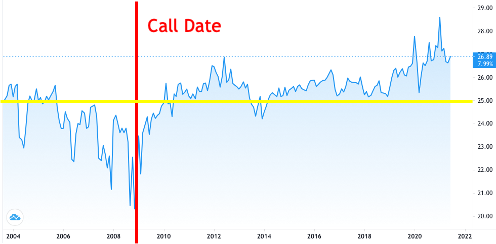

A example is the Gabelli Utility Trust, Inc., 5.625% Series A Cumulative PreferredShares based on the Gabelli Utility Trust CEF, which is trading with an insane 68% premium. With an issue date of 2003 and a call date of July 2008 this is a good example of a preferred share that has not been redeemed at or after the call date until now. It has a quarterly fix dividend and A rating.

What is interesting to watch here is that the volatility decreased right after the call date as expected despite the coincidence that this was the time of the financial crisis 2008/2009. After that time the price fluctuates around the face value of 25 CAD. Only at the end in 2021 it cannot decouple itself from the surging stock price development and goes a bit further away from the face value despite the call risk.

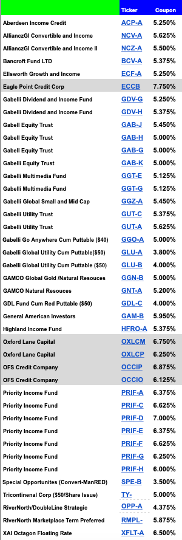

The above is a list of all CEFs that issue preferred shares. Among them we find well-known CEFs like ACP, ECC, OXLC, XFLT and some Gabelli funds. So there is choice.

Canadian Split Shares

A Canadian specialty are split shares from split companies and split trusts, both covered preferred shares. Split share are split, as the name suggests, into a preferred share of e.g. 10 CAD and a capital share of 15 CAD. The preferred shares receive their fix dividend, while the capital share receives the rest of the earnings.

Both papers are separately traded at the TSE with their own ticker and price. The preferred shares target risk-averse income investors while the capital shares address more risk seeking investors.

A split corporation and split trust have a limited time of existence at which end they are terminated and the assets of the company sold. From the earning the preferred shares receive the redemption of their face value, there the 10 CAD. All the rest is distributed to the capital shares if there is something to redeem. If not these they receive less than their 15 CAD or even nothing. Potentially the redemption of the preferred shares could be shortened after that as well but that would be rare. On the other hand when there is more to distribute, say 30 CAD, then this is all the capital share holders money. So the capital share is highly risky but has potential huge opportunity for extraordinary income. Here we would be more interested in the defensive preferred shares though.

Information Sources

In contrast to ETFs the information sources on preferred shares are not as elaborate and fancy with less capabilities for analysis but nevertheless they exist. For US preferreds

- https://stockmarketmba.com/listofpreferredstocks.php

- https://innovativeincomeinvestor.com/preferred-stock/

- https://www.spglobal.com/spdji/en/indices/fixed-income/sp-us-preferred-stock-index/

- https://www.preferredstockchannel.com

For Canadian preferred share the following sources:

- https://canadianpreferredshares.ca/list-of-canadian-preferred-stocks/

- http://prefinfo.com

- http://prefblog.com

- https://money.tmx.com/en/quote/^TXPR

- https://www.tsx.com/listings/listing-with-us/sector-and-product-profiles/closed-end-funds

Besides special portals, where I like most the innovative income investor side, there are also special pages on trade exchanges on the asset class.

Investment Case

Preferred shares are a very interesting investment vehicle and asset class for the defensive part of the portfolio, that I would prefer to high yield bonds. That is of course a personal opinion and everyone should think it through himself. the advantage of preferreds, depite their lower seniority to bonds is the better rating and that it is so attractive to companies that issue them that we can somehow rely on the fact that they would only in urgent rare cases not pay the fix dividend, especially also because they are bought mostly by institutional investors that rely on the high yield for income.

Regarding collective instruments we have to contest that the window of opportunity for preferred share CEFs has mostly closed leaving only one CEF with a discount and that is JPC. As this candidate is a more conservative one I would recommend buying if there is an opportunity like a dip as some weeks ago. I confess that I did exactly this.

A certain disadvantage of CEFs in this field is the high amount of preferreds from financial institutions.

The only UCITS Invesco ETF does look very promising to me and we hope that it will persist as an alternative in the market that otherwise would not be investible for European investors as a collective instrument.

Therefore for this asset class it might, and Luis Pazos agrees to this in his book, be worth do stock picking for single preferred shares to suit the specific needs of the investor. That does require though a good deal of studying the investor material which is not easy due to the jurisdictional language of the documents.

Especially covered preferred shares from the non-banking sectors like infrastructure or utility companies and solid REITs could be promising because more defensive than financial titles.

Comments are closed