I do not want to repeat in detail what ETFs are, there are hundreds of sources that do hits, please be prepared. Just a small systematic analysis of what components index investing with ETFs has.

Exchange-traded Funds (ETF)

First an ETF is about investing into an index, which is a own asset class. An ETF is a fund in contrast to a single stock, and a fund that invests in all significant participants of a market or market segment. Then an ETF is an exchange-traded product (ETP) that can be traded on a stock exchange just like a single stock with a price being build every minute, in contrast to mutual funds that get a price once a day from the fund company.

With investing in ETFs you implicitly decide on an investment style or strategy, that is index or market investing. This means being satisfied but also getting at least the market yield except for the tracking error. An ETF is very liquid and should be low risk in contrast to single stock investing due to the large volume and number of investors in ETFS. There are spreads when buying but liquidity should its best to keep them small. ETFs are flexible you can get them compounding or distributing dividends. Finally the major advantages are the low cost with total expense ratio (TER) of under 1% in contrast to over 1 up and beyond 2% per year with CEFs and mutual funds.

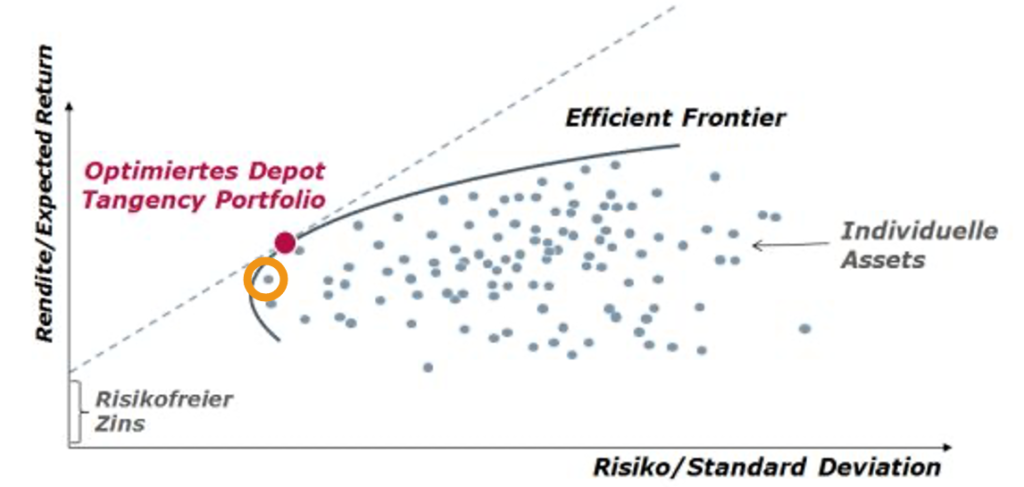

Modern Portfolio Theory (MPT) tells us that the efficient frontier contains all those investments in a portfolio of assets that is optimal regarding the relation of expected return and risk measured in volatility (See video https://youtu.be/mVBnvyWGesA regarding this topic). The index of a market is in this picture at the very left of the curve with the lowest volatility of all asset combinations. Maybe not with the optimal return but at least the lowest „risk“. So from the theoretical standpoint, there seems to be a good reason to invest in an index in order to reduce the portfolio risk.

Furthermore, literature, like Gerd Kommer here in Germany, have proven, that it is very hard to beat the market represented by the index. Sources from the market support this detailed claim, e.g. the S&P US Scorecard. Regarding this report, depending on the index/market, more than 70% or even more than 80% of all funds underperform the market. And even if one can find indications that e.g. large cap growth stocks in small indexes have a hard time to outperform the market, such as the German DAX. Just because the index is so efficient, that a fund manager has no manoeuvring space to perform better than the market. But there is no clear pattern in the ables except that of course nowadays growth stocks in the US tend to outperform their index more than value stocks. But times had been different already as well.

Advantages of ETFs

Of course it is easy to cover a complete market with an ETF thus getting the market yield, which usually is much better than what the average investor can achieve in the long run. By covering the whole market, diversification should be superior to CEFs and mutual funds in the general and therefore the risk, as we have seen when measured a volatility only, should much lower than with single stock picking. At least for the usual equity ETFs liquidity is very high and cost (TER) is lower than almost all other funds, which is one of the major benefits to improve compounding yields over the years.

ETFs are basic instruments that can be used in option trading and also with certificates and other derivate investment vehicles, even if that is clear betrayal to the basic idea of index investing.

Because the idea is that you make a savings plan monthly an don’t look at the development of the market and single stocks until you look again at it when retirement nears.

Disadvantages of ETFs

But watch out, that there are a couple of issues you should be concerned about:

- Diversification might not be so optimal as one could think

- There is a tracking error the sampling replication method of the larger ETFs. Thus the small caps in the index are not really physically replicated in an ETF but instead more of the large caps that are more liquid and cheaper to be acquired by the fund manager.

- Countries are not equally represented in ETFs, nor are currencies. Most large world ETFs are in USD and the US is highly over-represented in the holdings. There is of course a reason for this as US companies are a large share of the world economy but it still exposes the ETF to special US and USD risks. Youtube if full of these warnings.

- Spreads can be high, especially if a German investor buys the ETFs at the wrong trading time in the day. US-denoted funds should be bought at times where US stock exchanges are open, same for Asia.

- Even high yield ETFs provide pretty low dividend yields, mostly below 5%, which would be a typical minimum yield for an income investor.

- An index is highly efficient in contrast to darker corners of the stock market, so it will not be possible to buy an index at a discount, as value investors at least love to do.

- There are in the mean time ETFs that betray the very idea behind index investing, such as short or highly leveraged ETFs or ETFs in very small niches.

- Finally being able to use ETFs for trading, that means buying and selling in short times to make a short-term gain is against the idea of buy and hold for long term wealth acquisition.

The Problem with Index Investing

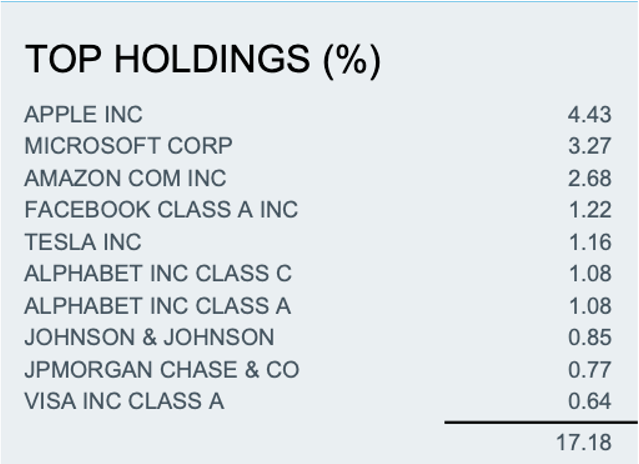

Now to the worse problems. If we look at the major equity ETFs their top holdings are almost exclusively the large US technology and growth stocks in the S&P 500. But that is the same if we look at emerging market ETFs, where we find Alibaba, Tencent and co.

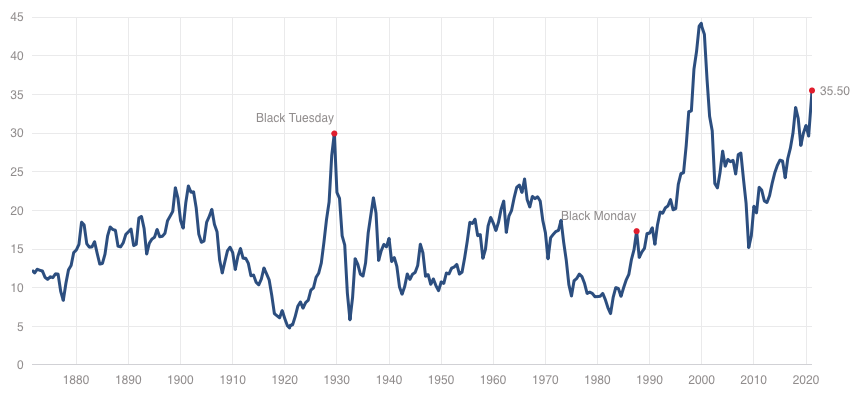

These position that take the largest shares in the major ETFs are exactly those stocks that have at least in the recent years had the highest development regarding price and therefore the lowest historical PE ratio.

So the equity ETFs are full of the major growth stocks in US and also EM. These are exceptionally expensive and over-represented anyway. Plus ETFs are in fashion so there was and is a large fund inflow in this investment vehicles. What does that do? It means that the ETFs need to buy more of these expensive top holdings, which boost further the price of these stocks. It’s a reinforcing circle. The ETF is forced to track the index as closely as possible and therefore forced to buy that stock.

Then what happens when there is a change in the index, e.g. Tesla coming in? The ETF is forced to buy a lot (#5 position!) of that overpriced stock on the market (I’m in favour of Tesla, don’t get me wrong)! And on the other side cheaper smaller stock needs to be sold. So you do anti-value investing in the end. The ETF buys into the growth trend that is already there at a premium, that means for a very high and bad price.

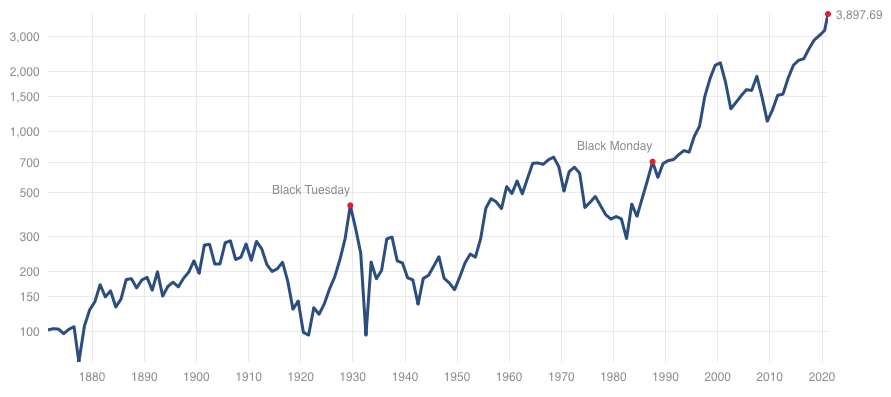

You might say, as long as the valuation of these growth stocks will even further increase, no problem. But it will not. The higher the ETF buys these titles, the higher is the dropping height and therefore the risk (remember the impact). The next crash is for sure, just the timing is unsure (remember likelihood). That means there will be a big loss for the ETF at some time, just as the market tanks. And the ETF investor is fully in it.

Warren Buffet says, „Rule #1 don’t loose money, rule #2 remember rule #1“, so exposing itself to such a high risk is not a good idea, at least when seeing it, right? We expect that the investment into an ETF is especially low risk and now we find out that there is a hidden high risk in this investment vehicle!

What happens here is that index investing moves to being growth investment with all the negatives associated with it, as discussed before. For a value investor this is a nightmare. We want to buy low and sell high and not the other way around. So is index investing for you?

Decision Tree

As usual the answer is, it depends. If you decide you want to invest in the stock market, you need to decide if you have the time, motivation and skills to look in detail in the financial market and single asset classes, instruments and stocks. If the answer is no, then index investing is the way to go, independent of the pros and cons discussed above. ETFs are the suitable instrument to setup a savings plan and forget about it until you need the money e.g. for retirement.

If the answer is yes, you have two choices again. If you want to follow experts, of which the financial industry has plenty of (e.g. see seeking alpha). You will get lots of recommendations to buy into growth stocks and the latest trend like H2, Covid-pharma and the like. OK you are a growth investor then probably like most out there and you might want accompany your fun portfolio with a ETF portfolio for retirement, if the one part of your investment goes bust in the next crash (wish you luck).

On the other side, if you said, ok no I want to become an expert myself and get financial education and learn about markets and single stocks yourself in detail, then value investing might be right for you! It does need a lot of time and work and analysis, some channels like Sven Carlin’s or mine can support you on that way but you are looking for lower risk and higher returns, great!

You could combine a value investing approach with income investing for long-term distributions to get an income, carefully selecting opportunities. Unfortunately ETF would not belong to the low-risk portfolio due to what we have analysed before. Rather CEFs and single value stocks should be in your portfolio then. ETFs would rather be a smaller „risky“ part, paradox but true.

I’m aware this is a controversial theory and I would like to get honest feedback from you, please use the Youtube comments.

Comments are closed