I have to admit that I was and still am very interested in Asia (ex-China), especially Japan and (South-)Korea. In the past I learned a bit of Japanese and studied privately the culture of Japan and Korea.

Thus I was very astonished last year to learn, that Warren Buffet, the famous investor that always preferred US stocks like Coca Cola, had been investing big in Japan. I had been aware of the term Keiretsu but Sogo Shosha was new to me, so it is getting time to dig a bit deeper into this world, than others do. It is really interesting, follow me please.

First what happened? In August 2020 it was published that Warren Buffet bought 5% in each of the 5 major Sogo Shosha with a volume of about 6.5 billion USD. And people were puzzled, what are these companies and why did he do this? Now we are 3/4 years later and the yearly financial reports and presentations are out (Sogo Shosha have a business year from March to March 2021).

What is interesting in the Japanese market that has underperformed not only for years but for 3 full decades, 30 years or the so called lost decades. Even the last 5 years the NIKKEI 225 index has shown just a sidewards movement until after the Corona-crisis when after Buffet invested, there was the first upward trend, although not as strong as the S&P 500 of course, to be seen. So Buffet was right again, or?

Sogo Shosha (総合商社)

So we should first ourselves understand Japan and the Japanese market and anyhow what does Sogo Shosha mean at all?

総合商社 = “to combine a wide range of functions, goods, and services into one commercial enterprise”

Japanese diversified trading conglomerate

So Sogo Shosha are horizontally diversified trading companies, usually integrated into a Keiretsu, but not necessarily. The major Sogo Shosha have around 100 billion USD revenue and consist of up to 500 individual independent companies. All of them have business world-wide and have companies in each major region or country. These mini-Sogo Shosha have up to 30 own subsidiaries themselves.

History

Sogo Shosha have been founded after the forced opening of Japan by the western forces for export and import of goods into and out of Japan. As they played an important role of providing resources and material for the Japanese war business, the US has destroyed these structure, previously called Zaibatsu, into their single hundreds of little companies. But due to the fact that the management has been kept as is, the conglomerates quickly reformed after the Americans left Japan. As Sogo Shosha they have played an important role in the revival of the Japanese economy after 2nd world war up until 1990. In that period of the years 2000 the relation between Japanese businesses and the trading companies broke up as the companies could more and more do the export and trade by themselves and didn’t need the Sogo Shosha anymore. So these had to reinvent themselves and again with the advent of the IT revolution which removed their information advantage. Now The producing companies could do marketing and value streams by themselves and the Sogo Shosha had to transform their business again.

Business

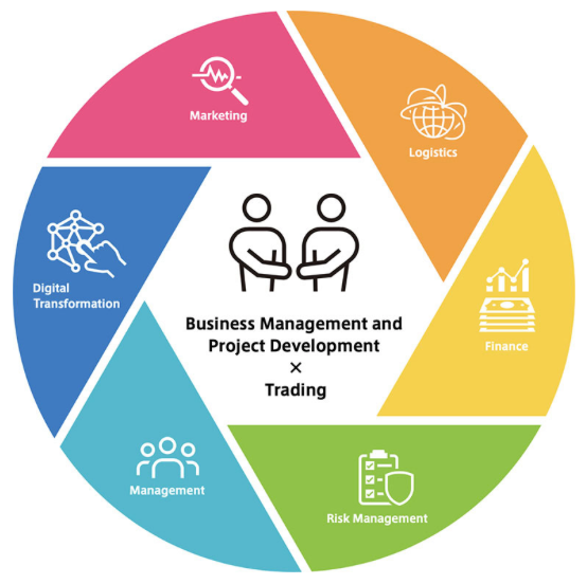

What does a Sogo Shosha do:

- Trading products

- Distribution of goods, logistics

- Organise large global projects

- Control supply chains

Traditionally they were trading goods and are specialised in the distribution of commodities or consumer goods. Economy of scale is critical and the companies handle 30.000 to 50.000 products world wide and earn on the masses. But in addition they developed the capability of economy of function, that is they provide non-trading services by making use of information. They know very well their markets, technologies and business oportunities and use their resources, people to find opportunities for business, logistics, moving goods, warehouses, IT supply chain services to customers, finance of trades, currency hedging, loans, futures, leasing, project finance etc.

Increasingly instead of only trading, they make investments in companies in supply chains, and do risk management (on credit, investment, country). That doesn’t make them a business development company (BDC) though. Often they have partnerships or are holding a share in a company without completely owning it. It is just about getting as much control over a different supply chains. They have to do this because in the information age, new business models tend to eliminate intermediaries. This happened already in the traditional business, where also Japanese companies sell their goods directly instead of selling through a Sogo Shosha, saving the margin in the environment of pressure in Japan’s bad economy.

Keiretsu (系列)

In order to understand Sogo Shosha it is important to understand another term, Keiretsu, the „traditional“ organisation of commercial activities in Japan. Keiretsu have a longer history, before WW2 they have formed as family enterprises, so called Zaibatsu. There were „destroyed“ by the Americans after the war but re-formed after the end of the occupation of Japan as Keiretsu in a different form.

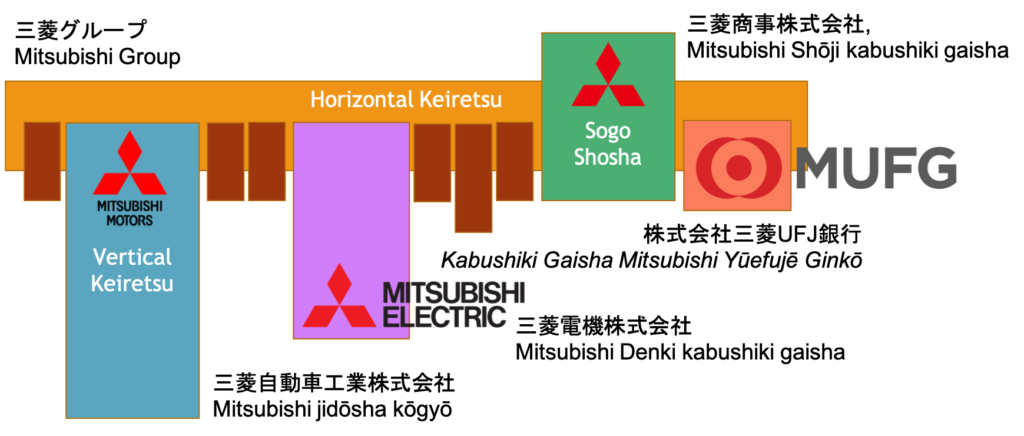

We have to distinguish between horizontal and vertical Keiretsu. A horizontal Keiretsu is a horizontally integrated group of independent companies with a shared governance structure. A vertical Keiretsu is a vertically integrated company, as we have seen plenty of in Russia. But often a horizontal Keiretsu contains vertical Keiretsu. Here an example of the Mitsubishi Keiretsu:

Each Keiretsu is centered around a bank (here Mitsubishi and UFJ Bank, aka MUFG) and can contain hundreds to thousands of independent companies that work together, like a family. Here it Keiretsu is the Mitsubishi Group, Mitsubishi Motors and Mitsubishi Electric are examples of vertical keiretsu inside the group Keiretsu. Then usually each keiretsu has a general trading company, the Sogo Shosha. Traditionally the Sogo Shosha is the interface to the outside world to buy goods for the companies in the Keiretsu and sell its products to customers in Japan and in the world.

7 Sogo Shosha

There are 7 large Sogo Shosha in Japan, we provide the code on the Tokyo Stock Exchange (TSE) in order not to pick the wrong stock and ISIN. With the US ticker symbols, note that there are 2 of them, the onese with a Y at the end are the ADRs and the ones with the F at the end are the original share traded OTC.

- Mitsubishi Corporation (Shōji) – TSE Code: 80580, Ticker: MSBHF, ISIN: JP3898400001

- Mitsui & CO., Ltd. (Bussan) – TSE Code: 80310, Ticker: MITSF, ISIN: JP3893600001

- Sumitomo Corporation (Shōji) – TSE Code: 80530, Ticker: SSUMF, ISIN: JP3404600003

- Itōchū Shōji – TSE Code: 80010, Ticker: ITOCF, ISIN: JP3143600009

- Marubeni Corporation – TSE Code: 80020, Ticker: MARUF, ISIN: JP3877600001

- Toyota Tsūshō Corporation – TSE Code: 80020, ISIN: JP3635000007

- Sojitz Corporation – TSE Code: 27680, Ticker: SZHFF, ISIN: JP3663900003

Warren Buffet was investing in the first and largest 5 of these. Toyota Tsusho is part of the Toyota vertical keiretsu, Mitsubishi part of Mitsubishi Group, Mitsui part of Mitsui Group and Marubeni part of the Mizuho Financial Group. In the past Itochu and Marubeni had been part of the same company. Sojitz is the smallest of the these.

Diversification

Sector diversification according to Global Industry Classification Standard (GICS) of the activities of the Sogo Shosha according their web sites:

| Sector | Industry | Mitsubishi | Mitsui | Itochu | Sumitomu | Marubeni | Sojitz | Toyota Tsusho |

| Energy | Energy Equipment & Services | x | x | x | x | x | ||

| Oil, Gas & Consumable Fuels | x | x | x | x | x | x | ||

| Materials | Chemicals | x | x | x | x | x | x | x |

| Construction materials | x | x | x | x | ||||

| Containers & Packaging | x | x | x | |||||

| Metals & Mining | x | x | x | x | x | x | x | |

| Paper and Forrest | x | x | x | x | ||||

| Industrials | Aerospace & Defense | x | x | x | x | |||

| Building Products | x | |||||||

| Electriacl Equipment | x | |||||||

| Industrial Conglomerates | ||||||||

| Machinery | x | x | x | x | x | |||

| Trading Companies & Distributors | x | x | x | x | x | x | x | |

| Commercial Services & Supplies | ||||||||

| Professional Services | ||||||||

| Air Freight & Logistics | x | x | x | x | ||||

| Airlines | ||||||||

| Marine | x | x | x | x | ||||

| Road & Rail | x | x | x | |||||

| Transportation Infrastructure | x | x | x | x | ||||

| Consumer Discretionary | Auto Components | x | x | x | x | |||

| Autombiles | x | x | x | x | x | |||

| Household Durables | x | x | ||||||

| Leisure Products | ||||||||

| Textiles, Apparell & Luxury Goods | x | x | x | x | x | |||

| Hotels, Restaurants, Leisure | ||||||||

| Diversified Consumer Services | x | |||||||

| Distributors | ||||||||

| Internet & Direct Marketing Retail | x | |||||||

| Multiline Retail | x | x | ||||||

| Specialty Retail | x | x | x | |||||

| Consumer Staples | Food & Staples Retailing | x | x | |||||

| Beverages | x | x | x | |||||

| Food Products | x | x | x | x | x | x | ||

| Tobacco | ||||||||

| Household Products | x | |||||||

| Personal Products | x | |||||||

| Health Care | Health Care Equipment & Services | x | x | x | x | x | ||

| Health Care Providers & Services | x | x | x | x | x | x | ||

| Biotechnology | ||||||||

| Pharmaceuticals | x | x | x | x | x | |||

| Life Sciences Tools & Services | x | x | x | |||||

| Financials | Banks | |||||||

| Thrifts & Mortgage Finance | x | |||||||

| Diversified Financial Services | x | x | ||||||

| Consumer Finance | x | x | ||||||

| Capital Markets | x | x | x | |||||

| Mortgage REITs | ||||||||

| Insurance | x | x | x | |||||

| Information Technology | IT Services | x | x | |||||

| Software | x | x | ||||||

| Communications Equipment | ||||||||

| Technology Hardware, Storage, Periphereals | ||||||||

| Electronic Equipment, Instruments & Components | x | |||||||

| Semiconductors & Semiconductor Equipment | ||||||||

| Communication Services | Diversified Telecommunications Services | x | ||||||

| Wireless Telecommunication Services | x | x | x | |||||

| Media | x | x | x | x | ||||

| Entertainment | ||||||||

| Interactive Media & Services | x | |||||||

| Utilities | Electric Utilities | x | x | x | ||||

| Gas Utilities | x | x | x | |||||

| Multi-Utilities | x | x | ||||||

| Water Utlities | x | x | x | x | ||||

| Independent Power and Renewable Electicity Producers | x | x | x | x | x | x | x | |

| Real estate | RETIs | x | x | x | x | |||

| Real Estate Management & Development | x | x | x | x | x | x |

As we can see Sogo Shoshas are active in almost all business sectors, from resources, materials, energy, utilities to consumer products, food via finance to real estate. Even the smaller ones are diversified to the extreme.

There is a large overlap in that respect although in some areas like chemicals the companies specialize in different chemicals. But all of them are betting on renewable energy in some way or the other. Japan has some important role in new batter technology especially.

Geographically the picture is simple, all companies are active on all continents and regions.

| Geography | Mitsubishi | Mitsui | Itochu | Sumitomu | Marubeni | Sojitz | Toyota Tsusho |

| Asia | x | x | x | x | x | x | x |

| Japan | x | x | x | x | x | x | x |

| China | x | x | x | x | x | x | x |

| Hong Kong | x | x | x | ||||

| Taiwan | x | x | x | x | x | x | x |

| Mongolia | x | x | x | x | x | ||

| Südkorea | x | x | x | x | x | x | x |

| Singapur | x | x | x | x | x | ||

| Philippinen | x | x | x | x | x | x | x |

| Kambodia | x | x | x | x | x | x | x |

| Laos | x | x | |||||

| Vietnam | x | x | x | x | x | x | x |

| Myanmar | x | x | x | x | x | x | x |

| Thailand | x | x | x | x | x | x | x |

| Malaysia | x | x | x | x | x | x | x |

| Indonesien | x | x | x | x | x | x | x |

| Brunei | x | ||||||

| Banladesh | x | x | x | x | x | x | x |

| Sri Lanka | x | x | x | x | |||

| Indien | x | x | x | x | x | x | x |

| Pakistan | x | x | x | x | x | x | x |

| Europe | x | x | x | x | x | x | x |

| UK | x | x | x | x | x | x | x |

| Irland | x | ||||||

| Frankreich | x | x | x | x | x | x | |

| Italien | x | x | x | x | x | x | |

| Deutschland | x | x | x | x | x | ||

| Östereich | x | ||||||

| Niederlande | x | x | x | ||||

| Belgien | x | x | |||||

| Dänemark | x | ||||||

| Spanien | x | x | x | ||||

| Portugal | x | ||||||

| Nowegen | x | x | x | ||||

| Schweden | x | ||||||

| Finland | x | ||||||

| Polen | x | x | x | x | x | x | |

| Czech Reupblic | x | x | x | x | x | ||

| Bulgarien | |||||||

| Rumänien | x | x | x | ||||

| Ungarn | x | x | x | x | |||

| Serbien | x | x | |||||

| Estonia | x | ||||||

| Griechenland | x | x | |||||

| Americas | x | x | x | x | x | x | x |

| US | x | x | x | x | x | x | x |

| Kanada | x | x | x | x | x | x | x |

| Mexiko | x | x | x | x | x | x | x |

| El Salvador | x | ||||||

| Guatemala | x | x | |||||

| Panama | x | x | |||||

| Kuba | x | x | x | x | |||

| Veneszuela | x | x | x | x | x | x | |

| Peru | x | x | x | x | x | x | x |

| Chile | x | x | x | x | x | x | |

| Equador | x | x | x | x | |||

| Kolumbien | x | x | x | x | |||

| Brasilien | x | x | x | x | x | x | x |

| Argentinien | x | x | x | x | x | x | |

| Afrika | x | x | x | x | x | x | x |

| Algerien | x | x | x | x | x | ||

| Marokko | x | x | x | x | x | x | |

| Ägypten | x | x | x | x | x | x | x |

| Tunesien | x | x | |||||

| Lybien | x | ||||||

| Äthiopien | x | x | |||||

| Ghana | x | x | x | x | |||

| Elfenbeinküste | x | x | x | ||||

| Sengal | x | ||||||

| Tanzania | x | x | |||||

| Mosambique | x | x | x | x | |||

| Nigeria | x | x | x | x | |||

| Kenia | x | x | x | x | x | x | |

| Angola | x | ||||||

| Südafrika | x | x | x | x | x | x | |

| Madagaskar | x | ||||||

| Russia + CIS | x | x | x | x | x | x | x |

| Russland | x | x | x | x | x | x | x |

| Ukraine | x | x | x | x | x | x | |

| Belarus | |||||||

| Kazachstan | x | x | x | x | x | x | |

| Uzbekistan | x | x | x | x | x | x | |

| Turkmenistan | x | ||||||

| Azerbaijan | x | x | |||||

| Australia + Ozeanien | x | x | x | x | x | x | |

| Australien | x | x | x | x | x | x | |

| Neuseeland | x | x | x | x | |||

| Papua Neu Guinea | x | x | |||||

| Middle East | x | x | x | x | x | x | |

| U.A.E | x | x | x | x | x | x | x |

| Qatar | x | x | x | x | x | ||

| Oman | x | x | x | x | x | x | x |

| Saudi Arabien | x | x | x | x | x | x | x |

| Jordanien | x | x | x | x | x | ||

| Kuwait | x | x | x | x | x | ||

| Iran | x | x | x | x | x | x | x |

| Irak | x | x | x | x | x | ||

| Türkei | x | x | x | x | x | ||

| Israel | x | x | x | ||||

| Bahrain | x |

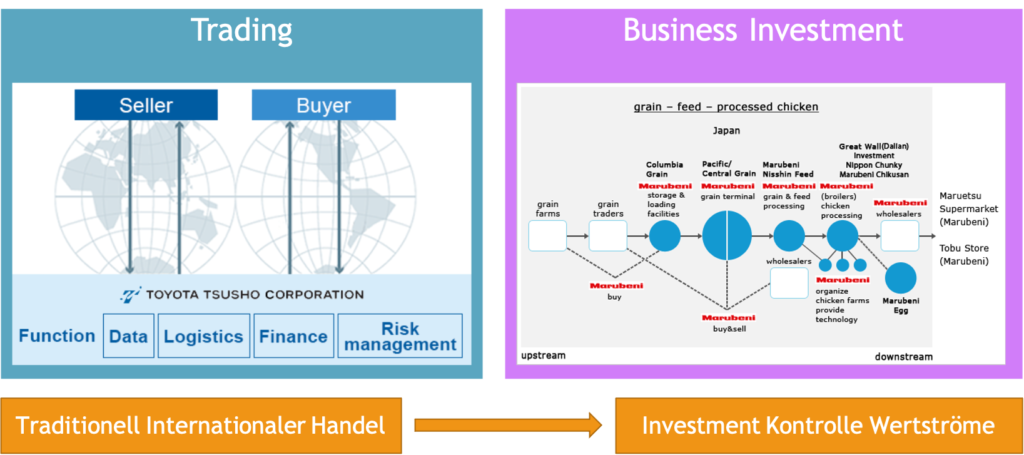

Transformation

While historically the Sogo Shosha have concentrated on trade activities, due to the changes in the market environment they needed to adapt to stay in business. So they not only support the trade by performing the goods transfer with logistics and trade finance, risk management they now try to control the value streams using important control points. And instead of only buying goods, they invest in companies and facilities that provide access to raw materials and goods financially. So Sogo Shosha have shares in BHP, Vale or the food producer Dole.

Away from traditional trade and supporting activities Sogo Shosha are moving to investments and other measures to control the value stream indirectly. We have to remember that the are not usually the company that does the main manufacturing, mining or production of a good itself but „only“ the trade activities around this. So the do not have the direct control over the value creation but have to occupy certain control points in the value chain that indirectly control the flow of goods and services.

Examples are owning a share of a mining company, financing or even operating of critical logistics facilities such as tanks, specialised or general container terminals, chartering the shipping transfer etc.

Furthermore the Sogo Shosha more and more try to do the retail to the end consumer by themselves in order to not be forced to rely on other companies to generate the demand for the goods they trade. So the own super markets and stores directly.

The other way to generate indirect demand is by managing large complex infrastructure projects that need services from other companies in the company conglomerate. If we think about the operations of a hospital somewhere in India or south-east Asia. Such a hospital needs pharmaceuticals, that need logistics, it needs a facility that requires an infrastructure project, that requires real estate management and financing. It also needs local energy, which might require business development and so on. The point now is that the diverse companies of the Sogo Shosha provide all these services, so there is demand for these generate by this project on the one hand and this produces a lot of synergies inside the conglomerate on the other side.

Investing in Keiretsu and Sogo Shosha

So finally, how can one invest in this business:

- Invest in single companies of a Keiretsu, such as the automotive or electronics company of a horizontal or vertical keiretsu

- Invest in the Sogo Shosha of the keiretsu and therewith investing in the diversified portfolio of all the products that are traded in the conglomerate

- Invest in an ETF that the bank of the Keiretsu emits that contains shares of all companies in the conglomerate that is listed on the Japanese stock exchange.

There is e.g. an ETF from S&P issued by the Mitsubishi Bank S&P Corporate Group Index – Mitsubishi Group Index . Of course this is not a UCITS ETF and European citizens will not be easily be able in invest in such a fund.

While there are of coure American Depository Receipts (ADR) for the stock of the Sogo Shosha tradable on the NASDAQ OTC, it is always preferable to trade the shares directly on the Tokyo Stock Exchange (TSE), which can be done with some broker, like the Interactive Broker (IB) retailers such as CapTrader, Lynx, Banx.

Financials

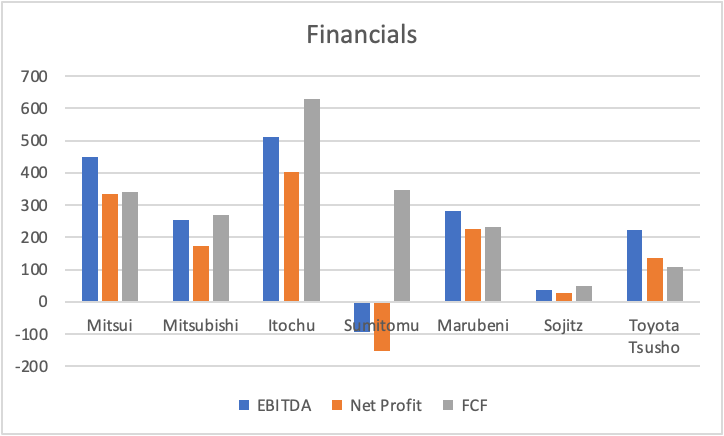

All the Sogo Shosha have been suffering from the Corona crisis last year financially, naturally as trade was especially impacted. So no surprise that all of them has declining revenues, EBITDA and profit. The fiscal year of all the Sogo Shosha is from March to March the next year, so end of March 2021 the fiscal year ended and meanwhile all the yearly financial reports are available, which is why I had to delay the article and video for a while.

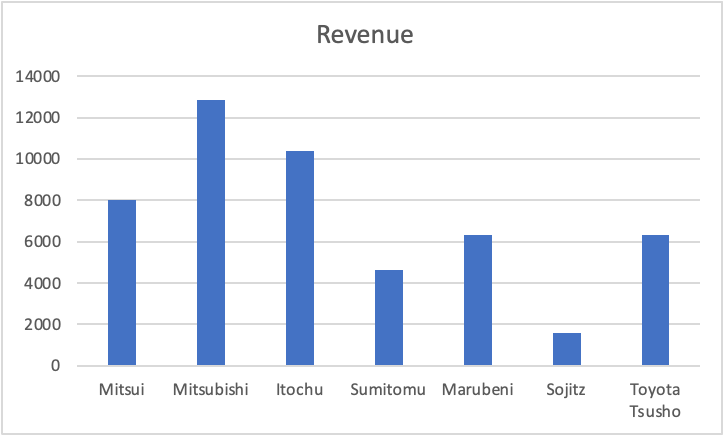

Mitsubishi had been the leader of the group of Sogo Shosha in the past, as we can see Itochu has taken over this position regarding profits, although Mitsubishi has still the larger revenue. Sumitomu, while still generating substantial FCF had larger financial problems due to write offs on a nickel mine in Madagascar, also but not only due to Corona issues.

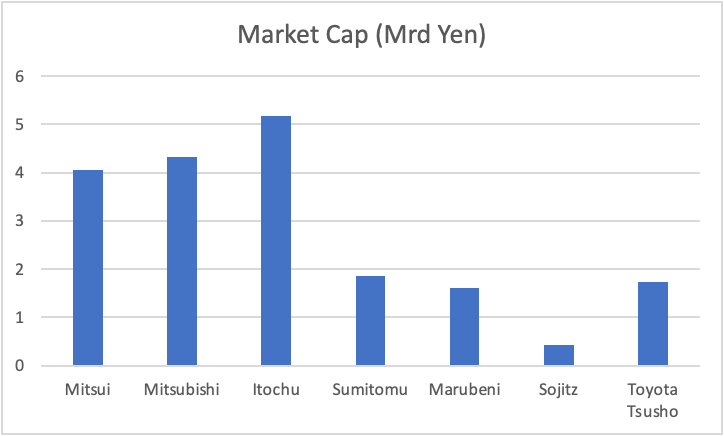

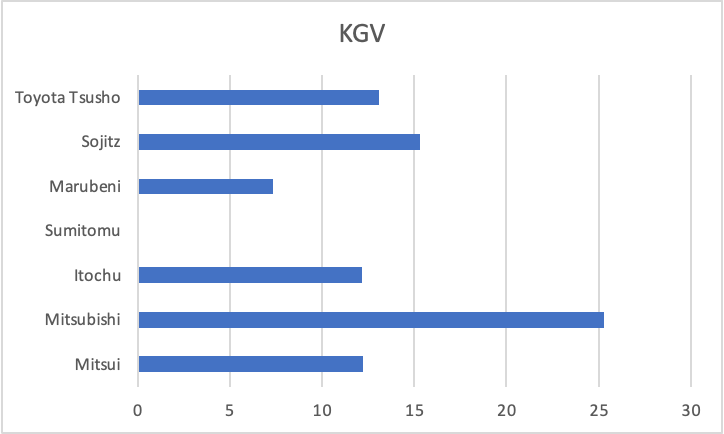

Regarding market capitalization Itochu has taken over the leadership from Mitsubishi as well. And that while Mitsubishi still has a PE ratio of 25, which is pretty high and Itochu has a PE ratio of only 12 which would be conservative in regards to its numbers. Sumitomu had losses and is in heavy restructuring in 2021.

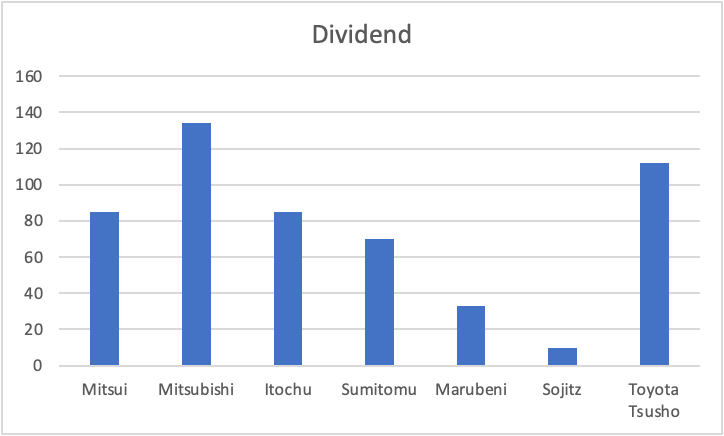

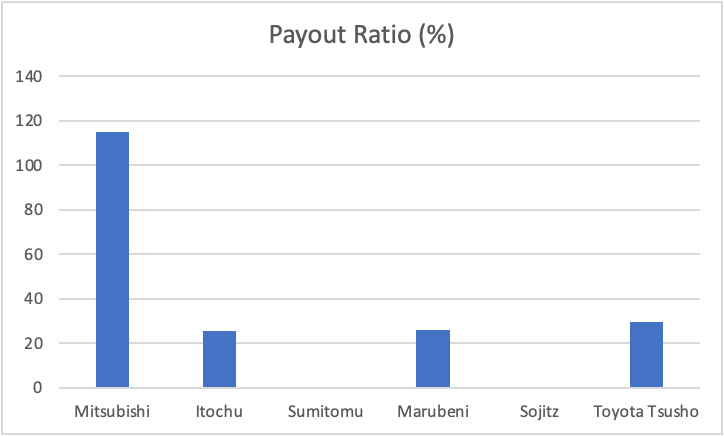

All of the Sogo Shosha are interesting for dividend investors as they pay a dividend and also maintained it last year. Even Sumitomu and Mitsubishi payed a dividend in 2020. See chart in Yen per share.

As we can see in the chart on payout ratio, Mitsubishi has paid its dividend from the substance as did Sumitomu, not covered by earnings. While Itochu has a lot of air in its payout ratio, Sumitomu also had a high payout ratio of its earning in FY that ended March 2020, which is not a good sign. Sojitz reduced its dividend but plans to double it again next FY, while Mitsui even increased it and plans to increase it even further next year. All of the companies plan a increase in dividend payments per share next FY including Marubeni, Itochu, Sojitz and Mitsui.

As previously seen in the NIKKEI 225 development over the last 30 years there was not any significant movement of Japanese stocks and so it is the case for the Sogo Shosha with one exception. And that exception is Itochu, which exploded starting in 2016/2017 until today while all others had a sidewards movement basically.

If we look at the price development over the short term of one year one can also see that Toyota Tsusho and Marubeni started to follow last year, while Itochu was maintaining his high valuation. So clearly Itochu is not really cheap when one looks at the chart.

Investment Case

As a summary Warren Buffet was taking the easy road and simply invested 5% of each of the 5 Sogo Shosha, a way that will not be feasible for the private retail investor. So we have to pick one, if at all.

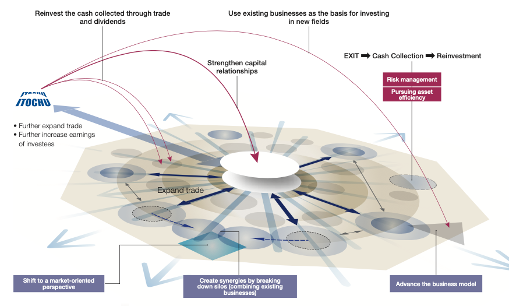

Investing in such a company conglomerate is like investing in an internationally diversified private equity fund and interesting enough, that is also how the companies see them selves at the stock exchange according to a statement from the Itochu investors material.

The Sogo Shosha have a hard time maintaining their business and need to constantly adapt and reinvent themselves. Trading opportunities are never really permanent and the companies need to constantly try to find new business opportunities, expand or cut these based on the success or failure to earn money with them. It is a type of portfolio management and it seems that some of them have a very strategic view on this business, such as Itochu, which has really excellent investor material.

All of the 7 companies have a shareholder orientation and try to generate trading income and dividends. As we have seen the field is not static and leaders can change such as the uprise of Itochu over Mitsubishi has shown. According to KGV and market valuation and its strategic direction Itochu could still be a good buy, especially if there is a chance to buy its shares in a dip or crash for less money. They had the largest growth and the best diversification away from the classical resource, energy/utilities and materials business but the good outlook is already priced in to a certain extend in the market as usual.

Mitsubishi has lost the leadership and is very automotive oriented and has payed the dividend from its substance which is not a good sign. To me it is unclear if they can regain their position, Itochu is clearly the more dynamic and agile company. Properties, that seem important in these challenging times of change.

Marubeni could seen as a challenger following Itochu with good growth. In the investor material I’m missing the clear strategy for the future though.

Mitsui is in the middle, it is more a classical Sogo Shoga focused on resources etc, which doesn‘ have to be bad really. They are heavily betting on healthcare businesses strategically. What I did not like is that there is dilution by new shares obviously by internal stock options.

Sumitomu finally had these large write offs that led to losses last year, but there is still considerable free cashflow generated. But there is a plan to get out of 101 from 400 business, where 32 businesses have already been terminated in 2020. While this might be good for a financial turnaround it sheds a strange light on the quality of the overall business, when one fourth of all member companies have a problem. Dividend has been maintained but already last fiscal year there was a high payout ratio, which indicates that the problems are not due to Corona crisis but structural. Whether Sumitomu could be a turnaround candidate needs yet to be seen.

Toyota Tsusho is part of a vertical keiretsu and very automotive focused. Every other business like chemistry and materials is always related to automotive. This can be positive with electro mobility but also negative as it is not as good diversified as the others. Toyota could of course play a big role in e-mobility as it is clearly ahead of European auto makers and has some stakes in battery technology.

What else I found interesting is the strategic direction of business in Afrika.

Sojitz, the smallest finally is second league clearly. They were cutting the dividend but can certainly double it again next year, as they plan. But I would not see that they can be a challenger for the others and are always number 7.

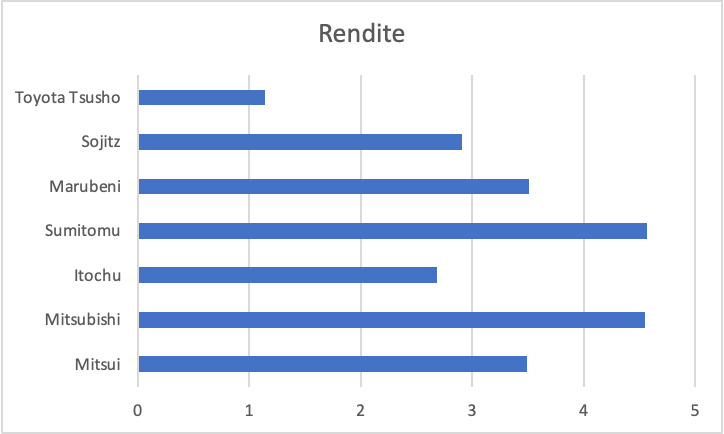

All 7 Sogo Shosha could be interesting for dividend investors, although yields are below 5%, so I would not consider them high yield. And of course the 2 players with problem have currently the highest yield due to low valuation. A fair value calculation is difficult but based on the KGV Itochu is still interesting and Mitsubishi is overvalued. Also Marubeni could still be interesting with their really low KGV in relation to the others.

Therefore I would consider an investment in this interesting and very different business model at least in Itochu and Marubeni and maybe Mitsui. But everyone has to decide and judge this by himself of course. And as a value investor waiting for the good opportunity of course.

Comments are closed