What you learn first in finance is, first improve your income, reduce your cost, especially bad loans, then build up a reserve before you start investing. One reason to have cash laying around. There are more motivations like one needs to maintain e.g. a security guarantee for renting out real estate or simply money that is maintained for making some acquisition. Furthermore one needs to have some cash at the side to make investments if there is an opportunity, such as a dip in the stock market or even the long awaited crash.

Where do we keep that cash, which as we know Ray Dalio said, is trash? Usually on some money market account or fix-term deposit. As the rule says, 5 – 10% in cash is a must with a minimum amount for a personal iron reserve of at least 10.000 EUR.

So what are then the alternatives to bunkering money as cash? What are the requirements for such a replacement?

Well, one should be able to retrieve the same amount of money one had put in the investment at nearly any time off the investment and have the original amount available or more. That sounds impossible, but let’s see.

So we want to see no long decreases in price as this would only allow us to take the money off the investment with a loss. It should give us more yield than the 0 or negative interest we get on a cash deposit.

Let’s go search for it!

Money Market and Foreign Banks

The first idea would be to check what we can get on the money market from other banks. We will find offers of up to 0,5% from some banks. But we will get very strange name that we do not know and that feel wrong. What happens, when you blindly give your money to such institutes, one can see with the default of the Greensill Bank in 2020, where a lot of municipal entities tried to park their money. And that risk taken for a meager 0.x%, definitively not a good risk-return relation.

Often these institutes are also foreign entities, which means that the securement instrument might or might not work for German citizens. And even if you go further away, e.g. VTB, the second largest Russian Bank, you get 0,1% on money market account and 0,65% on fix savings account. Not really attractive either.

Government Bonds

The most secure means one classically uses to secure a portfolio against losses on the stock market is bonds, usually used synonymously with government bonds of AAA-rated countries. Well, maybe the US but also Germany or Switzerland. Clearly you get even less interest than on your money market account, negative instead of 0,001%. So this is clearly not an answer.

Typically the interest of a bond and the smaller draw-down in times of crisis should compensate for losses in equity market in times of crisis. If there is no interest there is no such compensation and therefore no value in having (government) bonds, at least not for retail investors.

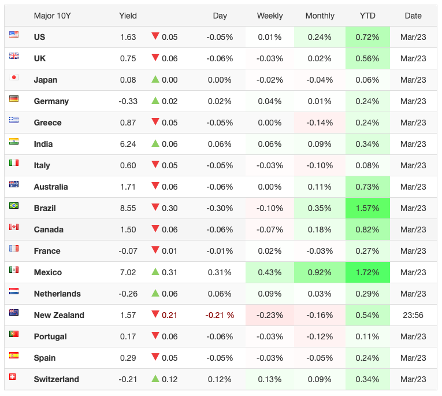

What about foreign government bonds. There are still countries that pay substantially higher interest, even in Europe, see https://tradingeconomics.com/bonds. Solid countries like Norway, Poland or Czech Republic offer at least more than 1% interest. Hungary, Romania, Island more than 3%, Russia has 7% and Turkey more than 17%. Ok in the later case you will loose a lot due to currency devaluation.

You might ask what’s bad with that? Well, these countries pay the premium in interest for a reason, at least except for Norway. So there is higher risk involved, economic risk in Eastern Europe or currency risk for Russia or especially Turkey and political risk.

It that is interesting for you, at least look for shorter maturity and liquidity of these bonds.

Corporate Bonds

If not government, the other type of bond is corporate bonds. Of course if we look for shorter maturity of e.g. 5-7 years with investment-grade ratings we also get a very low cupon and price of over 100% for nearly all such bonds. E.g. take the bonds of large corporations that are deemed secure also in times of crises such as Swiss Nestlé you get a 0,25% cupon with a AA- rating. Uninteresting like a government bond.

When we look for sub-investment-grade bonds with B-ratings, coupons are getting more interesting with more than 5%. But also here prices are at a premium above 100%, so buying is not a really good deal for the additional risk taken for this rating.

There had been a short opportunity during the corona crisis, in April/May 2020 where some bonds had discounts of 20% and more. If you bought then such a 5.x% bond you get an additional yield when either holding to maturity or selling now when prices are at a premium over 100%. But that time is over, try again in the next crisis. An example is e.g. the 5.25% coupon bond from Deutsche Rohstoff until 2024.

Ratings

The coupon is directly related to the rating by the big four rating agencies of course. For A-ratings one gets less than 1%, only when going to B-ratings one can expect to see 5% or more, where it starts to get interesting. A lot of normal mid-size and also large companies with solid business model have Ba* or BB ratings and should not be regarded as trash.

Emerging Market Bonds

We usually only think about bonds in developed markets, only about government bonds in emerging markets. But there are of course also interesting corporate bonds in EM. With a coupon of 7 – 14% we get a yield of 6 – 12% from such bonds.

| Bond | Kurs | Rendite | Kupon | Jahr Fälligkeit | Moody’s Rating |

| Gazprombank JSC | 99,49 | 6,29 | 6,1 | 2024 | Ba1 |

| Polyus PJSC | 101,98 | 11,49 | 12,1 | 2025 | Ba1 |

| Mechel PAO | 100,08 | 9,89 | 10,36 | 2021 | B3 |

| Acron PJSC | 100,7 | 5,41 | 10,2 | 2021 | Baa3 |

| Rosnetft Oil Comapny PJSC | 110,8 | 6,04 | 9,4 | 2024 | Ba3 |

| Transneft PJSC | 107,65 | 6,23 | 9,25 | 2024 | Baa2 |

Often it is difficult to get complete and correct information on western portals and information e.g. the important rating is missing. But especially in EM we should have a close look at the rating. Definitively a company such as Gazprom or Gazprombank is a solid company and probably it is safer to assume not to default than a German mid-size company with less yield. And the rating will confirm us that a company such as Mechel is in trouble, as we saw in a previous video, while Polyus or Acron are making good business.

But is it a good idea to buy a single bond, be it government or corporate in developed or emerging markets?

Issue with Bonds

There is though a major issue with bonds in general. Because interest rates are at a historical low, there is only one direction they can take and that is going up. Bonds are very sensitive to interest rates and when interest rates increase, the prices of the bonds will drop. Why? Because investors will rather invest in the new bonds with higher coupon instead of the old bonds with now lower coupon. therefore the old bonds need to decrease their price to stay competitive. As interest rate increase is much more probably than decreasing rates, this is bad news for buying bonds today, or?

You could only hold on to the bond until its maturity, which is quite fine for single bonds in the portfolio. But this defies our target of being able to sell the investment at any time without loss!

That is one reason why it is beneficial to buy bonds as part of a fund, because a fund will sell the old bond and buy newer bonds with higher yields in its rebalancing. That might mean a bit of loss but is compensated by higher yield from the new bonds correspondingly.

Even if you could do this yourselves having a diversified portfolio of bonds is by itself a benefit and that is hard to achieve for a retail investor as bonds usually have a minimum investment size. So buying fond of bonds is a easy way to get both benefits.

Defensive Part of Asset Allocation

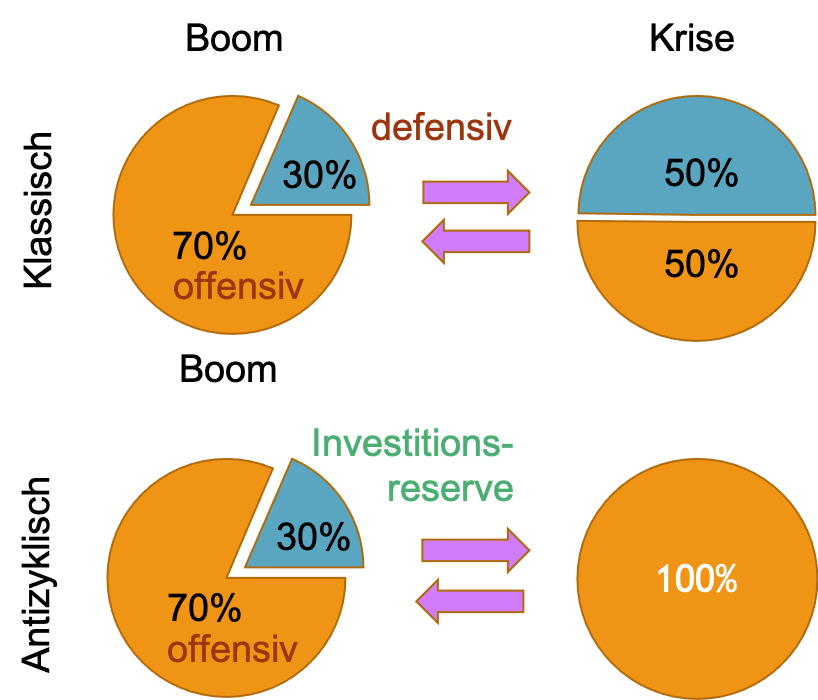

One more fundamental thought on bonds as part of the asset allocation. Bonds are a classical part of the defensive part of the asset allocation. According to public opinion one is supposed to hold a certain part of its portfolio in defensive investment like bonds, usually secure AAA-rated government bonds. And then in time of crisis one increases the share of bonds and sells equity to wait for re-entry after the crisis settled down.

I recently listened to a presentation from Andreas Beck about that topic of asset allocation on the online finance congress in Germany (see previous video). He says that we should focus on the economy and not on the financial market regarding our investment decision and as we know these are not necessarily developing the same way. A company can have a stable growing business with good earning but still the market valuation is low and vice versa. Like a value investor, as we are here, we want to look at the earning and the fundamentals in general in our investment decisions and especially, Beck says on the capital cost of the business.

This leads to an interesting strategy that I’ve been thinking of lately. Instead of increasing the share of bonds in time of crisis one should instead go all in 100% in stocks and sell its defensive part when the crash hits the stock market. So we use the defensive part of the portfolio as an investment reserve that we can sell independent of the market situation, exactly what I wanted to investigate in this article! That is a bold anti-cyclical investment strategy but for a value investor it totally makes sense. When the stock market is down we want to use the opportunity to buy more the stocks that we are sure have a good business and value in the long-term, it’s an opportunity after the boom times of exuberance.

This this idea enforces me thinking that we should build this investment reserve with reasonable yield in good times to be able to sell them anytime if needed for the bad times. So let’s continue.

ETFs in Bonds

It is not an especially good idea to invest in single bonds, be it government, corporate, high yield or in emerging markets. Like stock picking this adds additional risks to the portfolio and additionally one usually has to buy bonds in increments of 1000 EUR, which makes it near impossible to build a reasonably diversified portfolio at least for a non-wealthy retail investor. Therefore we should look into funds that provide a diversified set of bonds and can be bought at the stock exchange in arbitrary amounts.

Obviously the first collective investment vehicle that comes to mind is exchange traded funds (ETFs). The advantages are clearly the significantly lower costs in comparison to mutual funds and a broad offering in the market.

But yields of government bond ETFs are as low as their assets and so are ETFs in corporate bonds. ETFs in emerging market bonds might be more attractive but have significantly higher volatility that defy the requirement that we want to get out of this investment at anytime in times of crisis. The only type of bond ETF that generates enough yield above inflation are high yield corporate bonds with about 3.x%.

There is a reasonable large list of corporate bond UCITS-compliant ETFs with physical replication in USD and EUR, not necessarily hedged. But the list is shorter than expected with very risky ETFs included like fallen angel bonds. Outside of the Euro zone there are fare more offerings in this segment than regulated by the MiFID II regulation. And many of the few ETFs do have a shorter history. This history looks good with pretty stable valuation over time but none of them saw a bear market like 2008. The ETFS had a small maximum drawdown in 2020 of around 7% and recovered reasonably quickly to their old values but a bit slow so.

Typically for ETFs there is disadvantage that the ETF buys the whole index and there might be low rated or badly performing bonds in the index. But when the index is constructed cleverly this should not be a problem and a yield of over 3% is reasonably good.

ETFs in Preferred Shares

The second asset class for defensive portfolios is (US) preferred shares that are between bonds and common stock. Unfortunately in the Euro zone there are only 2 UCITS ETFs on preferred stock with rather short history and very low volume for an ETF. One from Invesco distributing with 4.4% yield, 0,55% TER and EUR-hedged with capital of 26 Mio USD. The other from VanEck, pretty new cumulating, TER 0,41% with only 4 Mio USD unter management, both physically replicating.

Outside of MiFID II regulation there are 13 ETFs on preferred shares with a lot more capital, sometimes in the Mrd USD. So here it shows clearly a disadvantage of regulation. Let’s hope that this will get better over time.

CEFs in Bonds

As presented in the previous blog article closed-end funds (CEFs) are an interesting active managed alternative to mutual funds and ETFs that offer all asset classes but usually come with leverage and more freedom in the instruments that fund management can use to push up the yield.

There is a big list of CEFs in corporate or municipal bonds as this segment is not regulated by MiFID II. There are big differences between the funds and yields can be expected to be from 3.x to 8.x% with TER between 1.x and 3.x%.

CEFs in Preferred Shares

Also in the segment of CEFs on preferred shares there is a much longer list than ETFs and yields are higher between 4 and 6% with a TER of around 2.5%. These CEFs show a very favourable valuation history with a very quick recovery after the 2020 crisis and thus a very interesting instrument.

CEFs in Senior Loans

At the top of the default hierarchy are senior loans. These have to be paid first in case of a default before bonds or even preferred share holders get re-compensated in this case. This makes this asset class the safes in corporate world. But loans are not liquid and not traded at a stock exchange. Therefore financial institutions bundle and rate them and make them tradable as collateral loan obligations (CLO).

CLOs are a form of asset-backed securities (ABS) to which belong also the collateral debt obligations (CDO) that have caused the 2008 subprime financial crisis. But CLOs use senior loans on corporations as their asset basis, while CDOs are backed by real estate and other loans there therefore are considered to be riskier.

BTW, mortgage backed securities (MBS) are similar to ABS and are the investment vehicle of mREITs, which I had mentioned in previous videos.

CEFs on senior loans, which contain CLOs have a significantly higher yield of 7 to 15% (!) but also TER between 2.5 and 14% (!). So there are clearly more conservative and very aggressively leveraging CEFs as TER includes interest rent. For our purpose of investment reserve preservation we might want to choose a more defensive fund.

While CLOs are theoretically and also practically safer than bonds there is the risk by having financial institutions bundle these. An expert in the CEF company needs to analyse these and we need to trust that. And trust in financial institutions is on a historical low like the interest rate, or?

When evaluating the risk of a CLO CEF we need to therefore look at the ratings of the portfolio holdings and make sure that the amount of C-rated loans is not too high, although that of course gives us more yield, so some is necessary. Being more conservative is nevertheless good here.

You should also check that the fund does not, and most don’t, use derivates on the loans such as credit swaps. There are shells on the loan assets and bring with them additional risk that we as retail investors might not fully understand in their complexity.

Furthermore one should check the mix of the debt instruments, often there are also bonds included together with CLOs and single loans. Also a mix of fix rate and floating rate credits might be desirable but there are also purely fix or floating rate funds available.

Also one should have a look at the mix of sectors from which the loans come from to get a good diversification.

Well known candidates in this sector are

- Eagle Point Credit Company LLC (ECC)

- OFS Credit Company Inc (OCCI)

- Oxford Lane Capital Corp (OXLC)

- Ares Dynamic Credit Allocation Fund (ARDC)

All of the above with the exception of ARDC are, at the time of this writing trading with a premium to their NAV, which makes them pretty unattractive for a value investor. Who wants to pay 1.2 for 1 USD without getting an extra risk premium? OCCI is BTW the one with the absurdly high yield and TER, while ARDC is pretty conservative.

Investment Case

IMHO it does make sense to use a combination of multiple of the described fund instruments for the purpose of parking the investment reserve in the market instead of having it rot on the money market account. But I would not buy single bonds of either kind but use funds instead exclusively.

I have to admit that one should probably use an ETF in bonds for the majority and combine it with CEFs in bonds with leverage for the higher yield, CEF in senior loans and CEF in preferred shares. Especially the later I find very interesting with their very flat valuation history and quick recovery after the crisis they’ve seen at least last year. These funds offer a better diversification and thus less risk than single bond investments, CLOs can’t be invested in by the retail investor anyway.

I would refrain from emerging market bonds for this purpose due to the volatility, although it might be more interesting for other purpose, especially when the fears of a bond crash in USD/EUR zone come true.

And as usual one should not forget to learn about the bond market, which is significantly different from the stock market and spend as many study time in these bond’s details than on single stocks or stock funds.

Finally one should of course not go all in and still have a part of money in cash. But at least the investment reserve or reserves for purpose of real estate maintenance etc. could be invested in this defensive part of the portfolio this way.

Comments are closed