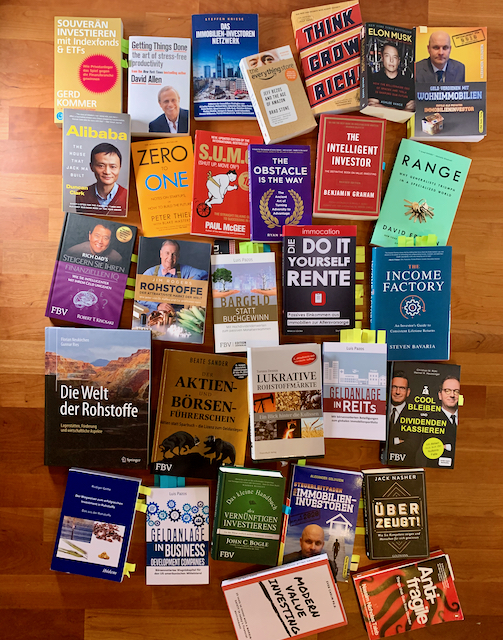

This year I have been reading 30 books to improve my financial education. I’m aiming for 100 books per year, so that was a clear miss regarding quantity but not bad either regarding quality.

The Classics

All financial educations needs a solid basis, so I did read some classics on finance, especially these (images are affiliate links to Amazon, thanks for your support):

Passive Investment

I started with books on passive investment, ETFs, using two of the classic books from Kommer and John Bogle. Kommer is most famous in Germany and the pobe of ETF investment with this work. His book is pretty large and very long to read, while Bogle’s little book is very consise and motivating to read. ETFs are the basis of any investment portfolio and good to get started.

Biographies

While I did this much too less in recent years, I started reading some biographies about famous business men such as Jeff Bezos (Amazon), Elon Musk and Jack Ma (Alibaba). I think it is important to understand how these famous and successful personalities think and how they became what they are today.

Jack Nasher

Prof. Dr. Jack Nasher is the master of negotiation and pope of lies (https://jacknasher.com). Nasher also has a Youtube channel (https://www.youtube.com/channel/UCBPoF5gW_irz-GK7bOTfiCA) that is worth viewing. This year I read two of three books that I bought from him:

Real Estate

The first asset class that I was interested in from the start was real estate. Therefore I prepared especially with books from Alexander Goldwein. His books are very easy to read and pure knowledge without further ado.

I also bought the Immocation book and one from a Immocation coach Jochen Mulfinger. His slogen „I can, but don’t have to“ is the ebodiment of financial freedom, to be able to do what you want, when you want, with whom you want and how.

Luis Pazos – nur Bares is Wahres

Luis Pazos is one of my absolute favourite blog and Youtube authors. His 3 books, that I all bought are the German standard work on income investing in general and REITs and BDCs in specific. His books showed me that there are many more investment vehicles than just stock, mutual funds and bonds. A must read for very value and income investor, about what this channel is about.

Income and Value Investing

Alongside Luis Pazos my newest favourite Youtube author is Sven Carlin (https://svencarlin.com) with his Modern Value Investing blog and Youtube channel. I found out that this deep analyst is probably the person with the most similar way of thinking than myself. Apart from his excellent Youtube channel (https://www.youtube.com/channel/UCrTTBSUr0zhPU56UQljag5A) Sven has also written a book with same title, that is a absolute reading recommendation!

The second book from Steven Bavaria, also a Seeking Alpha author like Sven, also gave me a extension of my horizon regarding finance. Income factory is obviously about income investing but to the extreme using investments that distribute almost all their earnings. It contains also helpful lists of CEFs in different categories that are good starting points for own investigations.

Commodities

Commodities are a very interesting subject for me, so I bought a couple of books to get myself introduced to the topic. The book from Jim Rogers is the motivational piece, the book from the Springer publisher more a reference book and the one from Rüdiger Götte about the commodities market, futures and basic concepts you need to know to invest in commodities.

I for myself decided to not invest directly into commodities for the moment, as I just don’t feel ready for futures and ETCs and am rather investing into mining and resource company stocks until then. But you should know why you choose a certain way of investing into a asset class versus others. And for this these books served well.

Mindset

Beyond financial literature, I also read some books that are more important for educating my mindset. One book about stoicism for not giving up too easily, a mental quality that is super important in life. Nudge is a book about choice design, giving little nudges so that people behave the „right“ way e.g. by choosing the right default. Range is about generalists, such as I am and this book helped me understand that this is an advantage. The book of why is really an IT book but also very interesting as it confirmed my strong suspicion that you cannot have AI with just data, that you need causality. The ladder auf causality explains the need of causal models, relationships for making really intelligent decisions.

Digital Transformation

Last year I had been educating myself mostly on business models and digital transformation and these books are the left overs this year. Especially the book from Alberto Savoia about doing the right it instead of doing it right was a absolute great influence on my thinking especially about my work in innovation management.

Finish

Last but not least, a book that I bought actually already 2018 but it’s still not completely read, because it takes all your attendance. I’m talking about Nassim Nicholas Taleb’s Antifragile. Understanding the difference between robust and antifragile was a revelation to me, especially at work for software systems. But it is also a important concept to understand in the world of finance, together with black swans. An epochal work that is a clear must read.

The other Nomad Capitalist is on my read list in the hope that I can set my future goal. To be able to work from remote, from some nice place in the south with a digital business. Keep dreaming with me.

I hope that I could add some interesting reading suggestion to your reading staple under the desk. Enjoy reading and working on your financial and overall education, especially in these challenging times.

Comments are closed