In a previous video I have investigated investment styles (or strategies): Investment Strategies and Income Strategies. So we met the styles of value investing and growth investing as the two dominant factor investment strategies.

Also remember the article and video about a alternative risk model: Systematic risk model for investors. What do these two topics have to do with each other? That’s what we will look at in this article and this video:

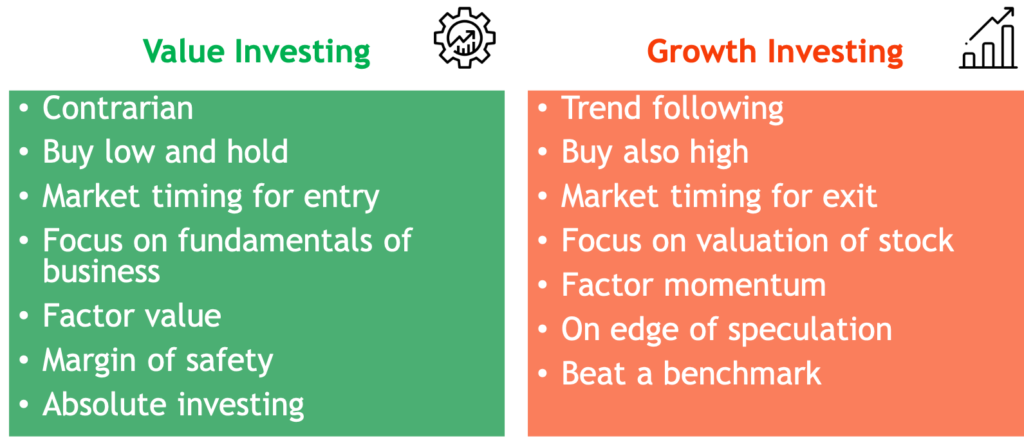

Value versus Growth Investing

This channel and blog is clearly about value and income investing, not about growth. But last year, the investors following a growth strategy were clearly outperforming us. But what are the major differences really?

A growth investor buys based on the valuation and the momentum of a stock. If he has the impression that the valuation could get even higher, he will follow the trend and buy even if the price is already high. He „just“ has to time the market to get out of the stock when the next crash is nearing. With a good growth stock, you can of course beat the market, as we saw last year, but until you sold it is just book money, not real one. So you have to stay alert to see signs of decline and sell in time and sometimes too early or too late, that’s life.

Price is what you pay, value is what you get

Warren Buffet

A value investor is not primarily investing in a stock but in a good business. Such a business will generate earnings and cashflow over the long run and grow moderately probably if the market understands this. So a value investor has to analyse the fundamentals of the business in order to time the market entry and buy for a discount. Because he buys for the long run and wants to have a margin of safety and not be forced to sell with the next crash. Instead he wants to buy and hold and get the distributions as income and participate in the positive development of the stock when the market sentiment turns towards the business. Buy buying low and selling high, as you should, in the long run a value investor can outperform the market with a part of his portfolio, even if it is just one or few values. And in the meantime forget about the valuation and sleep well, just like a passive investor but with this extra chance on an excess return over the benchmark.

It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price

Warren Buffet

Modern Value Investing (Sven Carlin)

When we talk about value investing, I need to mention my favourite blog and Youtube author: Sven Carlin.

He has also a book written: Modern Value Investing, which I discussed in my last video about my financial education and it’s of course a clear recommendation.

He’s the new master of value investing and therefore watch this video get an excellent explanation of value investing:

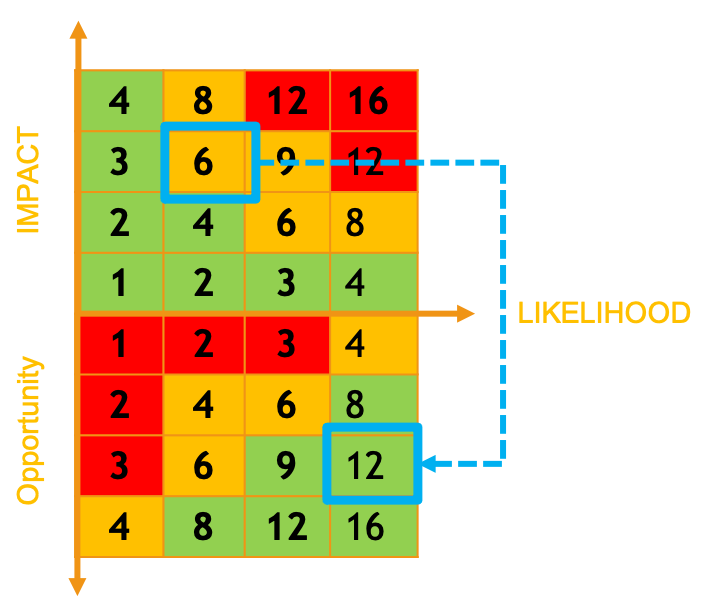

Investment Style and Risk

So what do these investment styles have to do with risk (and chance) anyhow? Remember the risk formula of our risk model:

risk = impact x likelihood

Based on ISO 31000 risk model

chance = opportunity x likelihood

Impact is the possible amount of loss, so maximum drawdown is a good candidate for this risk factor. Remember not the risk itself, that would be too one-dimensional.

So clearly, when you buy for a high valuation, the maximum drawdown and thus the impact is much higher, when realised. Now you could argue that this is just book value not real money, right, wait.

What we can clearly say is that a value investor that buys at a discount for a low valuation does have a lower impact in case of a crash, right?

Likelihood is the second risk factor and describes the probability that the loss will be realised. If we look at the window of opportunity that a growth investor can sell his position with a gain instead of a loss, you will agree, that these time slots are much thinner than the ones of a value investor, that can take its time to time its exit in peace.

Our favourite holding period is forever

Warren Buffet

It is being said, that value investing is riskier than growth investing. Now look at our model just qualitatively. Growth investing usually has a higher impact and a higher probability and therefore multiplied a considerably higher risk factor! Undeniably, right?

Low Risk – High Return

In the risk model we said that you have to live with the fact that a high return or opportunity comes with a high risk usually. Getting a high return with a low risk is the „holy grail“ and near impossible. Ok, I was not exactly correct with this last one.

Value investing claims exactly this, that you can have a high opportunity with a low risk. The argument with the low risk, we just argumented for. But the value investor also had a much closer look at the business itself and thus the risk of a complete loss, thus a default, should also be much lower than hunting just the latest trend stock without closely analysing it upfront.

Rule number one: never loose money.

Warren Buffet

Rule number two: never forget rule number one.

And because you buy low, you have a larger upside potential and also more time to realise it due to the larger window of opportunity to realise the gains. And because a good business is in the long run making good profits and has a sound balance sheet it will be at some point recognised by Mr. Market and valuations will follow this positive internal value.

If the business does well, the stock will eventually follow.

Warren Buffet

Then you also get growth and additional valuation wins in addition to distribution income meanwhile. It could take a bit longer but as investors we should not need the invested money for short-term spending, so it’s ok if it works out in the long run.

Summary

Of course at the moment it is hard for a value investor to find those stocks that have a good intrinsic value, growth potential and at the same time one can buy at a discount, due to the high valuations in the market. But there are those sectors that have been beaten last year for no real reason due to fear. Those sectors and the emerging markets, that had underperformed the US stock market in the past, are now the places to look to for these value candidates.

As they say it is only a bubble when it bursts, but we all now it will some time, even if we don’t know when. There is a lot of greed in the market, especially regarding growth stocks and that is a reason to have fear and be cautious with investment decisions. But nevertheless better to make those decisions based on good analysis that you find out there or do youself than standing on the sideline. Therefore I would like to close with the last quote:

be fearful when others are greedy, and greedy when other are fearful.

Warren Buffet

Comments are closed